Carbon Pricing

Potential emissions reductions from carbon pricing.

Carbon pricing is an essential part of any policy portfolio for reducing greenhouse gas emissions. Well-designed carbon pricing influences energy use and investment decisions, while creating a revenue stream that can be reinvested into researching and deploying low carbon technologies.

The two main types of carbon pricing are a carbon tax and cap-and-trade, and both offer a choice between price certainty and quantity certainty. A carbon tax has a fixed price for each unit of emissions (granting price certainty) and the emission outcome that follows is determined by the response of people and businesses to that price. A carbon cap, by contrast, sets a cap on the allowable quantity of emissions (providing quantity certainty) and the price of emissions is revealed through the trade of allowances.

Carbon pricing has been implemented mostly without issue or major breakdowns or market disruptions that might have led to a loss of confidence in the approach, and the policy has proven to be an attractive source of revenue. The main issue to date is that carbon prices have been too low, resulting in insufficient emissions reduction.

Carbon taxes and cap-and-trade are both important policies, and optimal carbon pricing policy will include elements of each, but a hybrid carbon pricing system is the most efficient approach to decarbonization. All carbon pricing should focus on three key policy design principles:

- Create a long-term goal and provide business certainty (at least 10 years);

- Build in continuous improvement; and

- Capture 100% of the market and go upstream or to a pinch point when possible.

Policy Description and Goal

Most regions of the world do not have a price on carbon emissions. When coal power plants spew CO2 into the atmosphere or natural gas producers vent methane, they are allowed to do so for free. Yet these emissions come with huge social costs. Carbon pricing creates a cost for producing greenhouse gases, discouraging their emission.

The introduction of a price on carbon emissions reflecting the damage they cause spurs investment in new low- and zero-carbon technologies while encouraging manufacturers, power plants, and others to reduce emissions.

Although it can be a source of cost-effective emission reductions, carbon pricing should not be viewed as a silver bullet. Political barriers tend to result in prices on emissions that are far lower than the true harm they cause to society, resulting in too few emission reductions. Additionally, many important emission reduction opportunities are not price responsive and therefore will not respond significantly to a price on carbon. An optimal policy package will combine carbon pricing with other policies to capture the price-resistant options.

Carbon pricing policies introduce a cost on carbon emissions either directly or indirectly:

- A carbon tax is levied directly through a per-unit charge on emissions of CO2 (or CO2e).

- A carbon cap, often called a cap-and-trade program or emission trading system, indirectly prices carbon through a requirement that large emitters acquire carbon allowances, each of which entitles the holder to emit a ton of carbon dioxide. The cap limits the number of allowances under the system. A market for allowances enables trading within and between covered sector.

The core goal of pricing carbon is to reduce emissions, but there are often ancillary goals—equity, reducing conventional pollutants, stimulating economic or technological development, and cutting other taxes, to name a few. The different goals should be made explicit, because they will affect choices about how to design the policy. Of course, any design must be politically palatable, which often requires making tradeoffs.

Pricing carbon to control emissions has several advantages:

- It is technology neutral.

- It is a source of low-cost reductions.

- It creates an incentive that radiates across all sectors of the economy.

- It reduces the information burden on regulators, helping to overcome information asymmetries. Because of the economy-wide nature of carbon emissions and the complexity of modern economies, each firm knows its own operations and market better than regulators ever could. Carbon pricing uses market forces to encourage companies to put that knowledge to work discovering emission reductions.

- The price signal affects investment decisions and behavior for existing energy infrastructure for both consumers and businesses.

- It generates revenue, which can be used to:

- Reduce inefficient taxes, thus stimulating the economy.

- Support a faster, more efficient clean energy transition, through deployment incentives (which help bring down future costs and can fund reductions the carbon price itself would not induce) and through research and development (R&D), which helps achieve a broader set of low-cost, low-carbon options.

- Accomplish equity goals, such as ensuring that disadvantaged communities share in the gains, through emission reduction projects in the most polluted neighborhoods or targeted economic support.

A carbon tax and a carbon cap, in their pure forms, offer a choice between price certainty and quantity certainty. A carbon tax has a fixed price for each unit of emissions, granting price certainty, and the emission outcome that follows is determined by the response of people and businesses to that price. A carbon cap, by contrast, sets a cap on the allowable quantity of emissions, providing quantity certainty, and the price of emissions is revealed through the trade of allowances.

Either a well-designed carbon tax or cap can successfully and cost-effectively reduce carbon emissions. Where there is significant momentum for either a carbon tax or cap, proper design is more important than the type of policy selected; the two approaches are more similar than different. Whether or not they produce a good result depends largely on design and execution.

One of the biggest challenges in designing carbon pricing is finding a way to lower emissions while minimizing economic impact. The optimal policy will achieve steep emission reductions without forcing industry and its associated emissions and jobs to relocate outside the regulated region. Such relocation to other regions is commonly called leakage.

The potential for leakage is often overstated, but it can be significant in sectors that rely heavily on global trade. When carbon pricing is applied to these sectors, it can be easy for manufacturers to relocate to other unregulated regions or for foreign manufacturers to out-compete the priced industry. The hybrid approach of blending a carbon tax with a carbon cap, discussed in the next section, helps balance environmental and economic goals.

The guidelines discussed in this chapter should be tailored to each jurisdiction. The following questions can help identify how the guidelines should be modified:

- How developed (and how large) is the economy that will be covered by the carbon price?

- What complementary policies does the jurisdiction have in place, and how will these affect future emissions?

- How strongly have neighboring countries or jurisdictions tackled climate change?

- Do trading partners have a carbon pricing policy or equivalent controls in place or under development?

- Are the policies applied piecemeal, are they customized for different industries, or are they uniform?

When to Apply This Policy

Every climate policy portfolio should include carbon pricing. In addition to being a strong policy for driving down emissions, carbon pricing can overcome some drawbacks of other types of policy while providing new benefits.

For example, it can often be difficult for government regulators to gain access to proprietary information from polluting industries, but carbon pricing helps overcome this information asymmetry. By setting a price and then allowing industries to reduce emissions based on their unique costs, technology options, and emission profile, carbon pricing significantly reduces the amount of information regulators need compared with performance standards or other policy types.

Carbon pricing can also yield public finance benefits. For example, taxing a social harm such as pollution is more economically rational than taxing desirable economic inputs, such as labor and equipment.

Nevertheless, carbon pricing is not a silver bullet: It is a necessary but not sufficient part of an optimal policy portfolio. The optimal policy portfolio instead combines carbon pricing with a broad set of other policy types including performance standards, support for R&D, and supporting policies.

Countries with large amounts of natural gas production and old gas distribution infrastructure, such as the United States, are prime targets for policies tackling methane leaks. Countries with large coal mining operations should consider ways to tackle coal mine methane. Any country that produces refrigerants and propellants should use policy to mandate a transition from F-gases to safer chemicals.

Detailed Policy Design Recommendations

Why and How to Create a Hybrid Carbon Price Program

Policymakers should consider both the price of carbon (which affects total program costs) and the targeted amount of emission reductions from the program. Because a carbon tax focuses solely on the price of carbon whereas a carbon cap focuses solely on the amount of emission reductions, using a strict version of either of these options can result in prices or emissions that differ from policy goals or expected outcomes of the program.

For example, if a carbon cap is set too low, it may result in higher costs than are expected or tolerable. Similarly, if a carbon tax is set too low, it may not deliver the emission reductions policymakers intend.

Policymakers can address these limitations by combining a carbon tax and a carbon cap into a hybrid carbon pricing program, providing a more balanced approach to managing uncertainty.

Technical foundation

Here, we introduce the types of uncertainty under either a strict carbon tax or a strict carbon price.

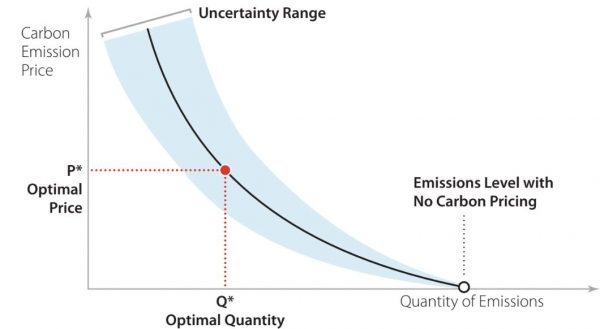

A carbon pricing abatement curve.

This abatement supply curve provides information on the cost to reduce the next unit of emissions at a given starting level of emissions. The vertical axis shows the price to reduce a unit of emissions, and the horizontal axis shows the total amount of emissions. The bolded center curve shows the cost of reducing emissions relative to the total amount of emissions. As total emissions decrease (moving from right to left), eliminating the next set of emissions (moving left again) becomes more expensive. This pattern is also reflected in the marginal abatement and policy cost curves.

The abatement supply curve can be used to illustrate the expected emission reductions under a carbon tax or the expected price of allowances under a carbon cap.

For example, a carbon tax set at the optimal price (P*) will lower emissions from the level with no pricing to the optimal quantity (Q*). Because reducing another unit of emissions is more expensive than just paying the tax, companies will choose to just pay the tax.

Under a carbon cap, a cap set at the optimal quantity (Q*) will result in the optimal price (P*).

Of course, the price of reducing emissions in the future is somewhat uncertain. For example, technological breakthroughs could significantly reduce the costs of reducing emissions. Similarly, changes in the price of goods or energy might make it more or less expensive to reduce emissions. This uncertainty is captured by the blue area around the black curve.

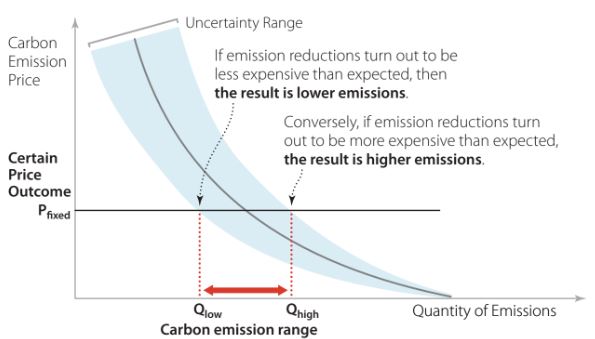

A carbon tax and a carbon cap handle this uncertainty differently.

At a fixed price, carbon pricing has uncertain emissions outcomes.

The total level of emissions could vary under a strict carbon tax. When the price of carbon is fixed, emissions can be higher or lower than expected, given uncertainty in the cost to reduce emissions. If reducing emissions turns out to be more expensive than expected, emissions might actually decrease only to Qhigh. Conversely, if emission reductions turn out be cheaper than expected, emissions might fall all the way to Qlow. In sum, although a carbon tax provides price certainty, it is accompanied by emission uncertainty.

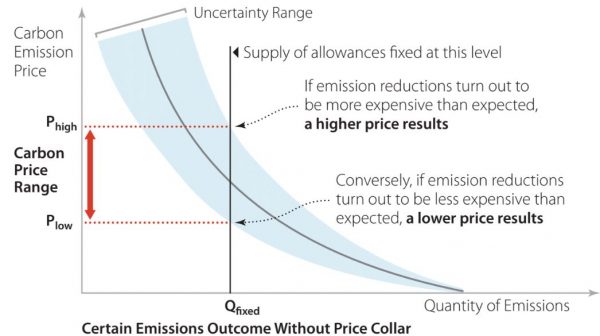

The inverse is true for a carbon cap.

At a fixed cap, carbon pricing has uncertain price outcomes.

When the total quantity of allowable emissions is fixed, the cost of reducing emissions to that target can be higher or lower than expected, given uncertainty in the cost to reduce emissions. If it turns out to be more expensive to reduce emissions than expected, the price of allowances under a carbon cap might be as high as Phigh. On the other hand, if it ends up being cheaper to reduce emissions than originally expected, the price of allowances might fall to Plow.

Ultimately, higher-than-expected emissions or higher-than-expected carbon prices might be unacceptable. Fortunately, combining a cap with a tax can balance these risks to reduce uncertainty.

How to create a hybrid carbon pricing program

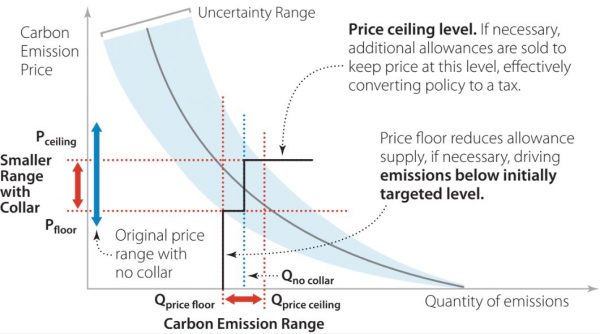

The ideal carbon pricing program is a hybrid of a cap and a tax. The hybrid approach is built on a carbon cap, with a strong science-based emission target and with a minimum (floor) and maximum (ceiling) permit price. If the price of the carbon cap drops to the floor or hits the ceiling, it becomes fixed at the floor or ceiling price, essentially becoming a tax.

This bounding of prices in a carbon cap program is also called a price collar. The use of a price collar helps ensure that a carbon goal will be reached unless carbon prices rise too much. (It’s worth noting that carbon reductions the world over have generally been far cheaper than expected.)

The hybrid approach turns the weakness of price uncertainty under a carbon cap into an advantage. The price floor creates the potential to drive significant carbon reductions if the price to reduce emissions turns out to be lower than expected, and the price ceiling ensures costs do not rise above acceptable levels. The design of a price collar is discussed in more detail later.

Policymakers create a price ceiling by agreeing to release (usually through an auction) additional allowances if prices reach the price ceiling. When the number of allowances increases, the price of each allowance drops. The option to release additional allowances is sometimes called adding a safety valve: If prices rise too high, policymakers can open this “safety valve” to increase the number of allowances. This approach effectively caps the price of allowances at the ceiling level, providing the price certainty guaranteed by a carbon tax.

To create a price floor, policymakers establish a minimum allowance price. The price floor allows policymakers to ensure a minimum price on carbon and corresponding revenue even if emission reductions turn out to be cheaper than expected. Over time, the minimum price should rise at a set percentage plus the rate of inflation so that using a price collar to create a hybrid carbon pricing program bounds uncertainty.

With the price collar in place, the price is guaranteed to be at least as high as Pfloor but no higher than Pceiling. Compare this range of prices, indicated by the vertical red arrow along the y-axis, with the original range of prices, represented by the blue arrow. The price collar significantly reduces the price uncertainty associated with the carbon cap.

At the same time, the price collar introduces some uncertainty into the quantity of emission reductions, as shown by the horizontal red arrow along the x-axis. The price floor effectively reduces the number of allowances available, ensuring at least a minimum level of emission reductions are achieved. At the other side of the price collar, this program design makes additional allowances available at the price ceiling to ensure prices remain acceptable.

A price collar can reduce the price uncertainty of a carbon cap.

So far, we have looked at how to create a hybrid carbon pricing system starting with a carbon cap. However, policymakers can also create a hybrid program starting with a carbon tax.

To create a hybrid carbon tax, the policy must adjust prices based on whether it is achieving the desired emission reductions. If emission targets are being met, the carbon tax does not need to increase. If emission reductions are falling short of desired levels, an increase in carbon tax would go into effect. To date, there are no real-world applications of this approach. However, one such proposal is being discussed in Washington State, and two recent research papers have taken on the topic.

Policymakers should use careful quantitative analysis of policy impacts to identify a desired emission trajectory and price path when determining price floors and ceilings. These analyses should incorporate social costs and benefits, including the value of improved air quality for public health. If policymakers are unable to afford sophisticated modeling, one option would be to borrow approaches of neighboring jurisdictions.

Admittedly, hybrid cap and tax programs are novel, and choices about caps and price floors and ceilings are nuanced. Some impacts will need to be considered on a qualitative basis in parallel with quantitative analysis.

Once the desired price and emission reductions are identified, policymakers must identify the price ceiling, floor, and trajectory.

For a hybrid carbon cap, policymakers should set a price floor below and ceiling above the expected prices from the desired emission pathway. Ideally, the price floor should be set at 50% below the expected allowance price in a given year, and the price ceiling should be set at 50% above the expected allowance price. The floor and ceiling should rise steadily over time, at a rate of about 5% per year, plus the rate of inflation.

For a hybrid carbon tax, policymakers should set a price escalation schedule corresponding to the share of reductions achieved relative to the goal. Emission reduction should be tied to emissions in the start year of the program rather than trajectories of business-as-usual emissions, which are often highly uncertain, if not completely inaccurate. The tax should be raised based on how much emissions fall in response to the carbon price.

If emissions do not fall at all, the tax should be increased by 7%. If emissions are reduced by less than half of the way to the target, policymakers can try increasing the tax by 5%. If emissions are reduced by more than half but still less than the goal, policymakers can try increasing the tax by 1%. These price increases should be in addition to the annual inflation rate.

Policy Design Principles

Create a long-term goal and provide business certainty

Carbon pricing policy should be defined at least a decade into the future. Major investments involve a long planning horizon, and investors need sufficient long-term certainty and commitment in order to integrate a carbon price, or any policy, into the investment calculation.

Build in continuous improvement

A carbon price or cap should steadily improve, with prices increasing and emissions falling. In combination with long-term goals, steady improvement builds demand for innovation, helping drive a market for new low-carbon technologies. Allowing the policy to plateau or weaken undermines the ability of companies to confidently invest in R&D.

Capture 100% of the market and go upstream or to a pinch point when possible

A cross-sector policy such as carbon pricing is well suited for broad coverage, which should aim to capture as close to 100% of emissions in the market as possible. Broad coverage discourages leakage. For example, if electricity is a covered energy source but natural gas combustion is not, then producers may shift to using natural gas instead of electricity to avoid the cost of a carbon price.

Administrative effort can be reduced by regulating at pinch points—places where the energy flows are concentrated. For example, petroleum refineries, where crude oil is delivered, or the terminal rack, where processed liquid fuels transition from ships, trains, and pipelines to local distribution, are a good choice for capturing oil-related emissions. In the electricity sector, utilities or power generators are better options for the point of regulation than end-use customers.

Carbon pricing programs often target emissions at large industrial sites, which include many types of facilities: petroleum refineries, electric power generators, cement plants, and so on. These facilities vary in size and emissions. Because some of these facilities have very low emissions and the cost of regulating them might outweigh the benefit, policymakers often need to establish a threshold below which emissions are not covered.

Yet the possibility of such a threshold may encourage some emitters to drop below in order to avoid regulation. To avoid industries clustering right below minimum thresholds, regulators can require the reporting of emissions below the threshold level for the policy.

For example, policymakers might tax industrial facilities only if they have emissions of 25,000 tons or more, but they can also require reporting of emissions for any facilities with more than 10,000 tons. Setting the lower reporting requirement allows regulators to see whether facilities are clustering right below the coverage threshold.

Prevent gaming via simplicity and avoiding loopholes

Carbon caps can be subject to gaming because of the nature of trading allowances and the use of offsets, which industries can use to show they are complying with a cap through investments outside the regulated region. Policymakers must establish a central registry to ensure that allowances are not used more than once.

Additionally, if there are only a few companies holding allowances, it creates the opportunity to distort the market and raise the price of allowances. Policymakers should establish limits on how many allowances any single market participant can possess to avoid a concentration of market power that might allow price manipulation. A common foundation for monitoring and enforcement of market power is third-party verification of self-prepared emission reports. Third-party verifiers should be assigned by policymakers rather than left to covered industries.

Leakage control

Leakage, discussed earlier, occurs when introduction of a policy encourages the industries being covered to move outside the boundaries of the area covered by the policy. Although many economists believe that leakage due to carbon pricing will be small, it is politically fraught. Much of the concern about leakage has focused on energy-intensive industries highly dependent on global trade, whose costs could increase significantly and make them uncompetitive relative to other unregulated competitors.

Leakage is more of a concern when carbon pricing is implemented in a smaller area, such as a single state or province, because emitters can move a short distance to escape the policy. As more and more regions take meaningful steps to control carbon emissions, the threat of leakage diminishes.

Carbon tax programs typically address leakage by exempting energy- intensive, trade-exposed businesses from having to pay the tax. Carbon cap programs typically address leakage by providing some free allowances to the same set of industries.

Identifying these industries and how many allowances to allocate for free can be challenging. The current state of the art is to use a method called output-based free allocation. “This method offers firms free allowances as a function of their levels of production in the current or in a recent time period.”

Where regions are part of a larger electricity system, carbon pricing must cover imported electricity, because it is easy for electricity generation to move outside the covered area.

Auction most or all of the carbon allowances under a cap

Policymakers have two options for allocating allowances under a carbon cap: giving them out for free or auctioning them off. Auctioning has many advantages over free distribution: It is the simplest approach for government, it avoids the economic distortions that plague all forms of free allocation, it facilitates price discovery, and it is a source of public funds.

Auctions are also the simplest means of introducing a price collar. A price floor is achieved by refusing to accept bids for allowances below a minimum price. A price ceiling is accomplished by making additional allowances available for auction once a price cap is hit. In this way, prices will rise no higher. Auctioning can also avoid turning free allowances into windfall profits for regulated industries.

Free allocation does not suppress permit prices or protect consumers in most cases. Even when allowances are given away for free, there is an opportunity cost to using an allowance, because using it means it cannot be sold. This implicit cost is passed along to customers even under free allocation, unless there is significant competition from firms not covered under the program.

In some cases, a transition period involving some free allocation may be appropriate. Free allocation of some allowances can help protect trade-exposed, energy-intensive industries, which may otherwise be motivated to move to another region with lower energy prices. Over time, however, there should be a transition to 100% auction-based distribution, with generic subsidies taking the place of freely allocated permits for trade-exposed industries in need of government support.

Revenue use

Carbon pricing creates a revenue stream. In turn, the revenue generated through carbon pricing can be used to accelerate the clean energy transition by funding research, development, and demonstration projects or incentives for deployment of low-carbon options that a carbon price alone would not achieve.

Using carbon auction or tax proceeds to drive down the cost of carbon abatement through R&D and deployment incentives creates a virtuous cycle, with each increment of carbon abatement helping pave the way for further, cheaper abatement.

Of course, there are many ways in which revenue generated through carbon pricing could be used. Some of the best options include:

- Using proceeds for general revenues to reduce distortionary taxes, to pay down the debt, to fund government, or as a “carbon dividend” to be paid directly to the populace.

- Offsetting costs that fall on certain consumers disproportionately, such as low-income households or trade-exposed industries.

- Spurring a virtuous cycle of reducing the cost of carbon abatement by funding R&D and other projects to reduce carbon pollution.

- Subsidizing end-use efficiency, such as building equipment and appliances, a particularly strong candidate because it can at once reduce transition costs for disproportionately affected groups and offer very cheap CO2 reductions.

- Promoting equity goals.

Regarding equity, programs should be structured so they do not exacerbate social, economic, or environmental inequities. In fact, intelligent use of the revenue generated by carbon pricing can and should deliver benefits in polluted or disadvantaged communities. Complementing pricing with other more direct pollution control policies is one way to ensure local emission improvements.

Another approach is to require some minimum level of investment of revenue in projects with local emission reduction benefits in the most polluted neighborhoods. Both should be core elements of a carbon pricing program.

Allow banking and borrowing as extra flexibility options under a cap

Carbon pricing is inherently flexible, allowing companies and households the choice of purchasing any emission-reducing technology or instead paying to emit. Banking and borrowing offer additional flexibility under a carbon cap.

With banking, covered entities retain unused allowances for future compliance periods. Under borrowing, allowances from future caps can be brought forward and used in present years under some circumstances.

Banking and borrowing allow industries to smooth out compliance over time, for example in response to changes in annual availability of hydroelectric power that may follow rainfall fluctuations. Policymakers should limit borrowing to situations in which carbon prices are high and when the reserve to maintain price stability (the safety valve mentioned earlier) has been depleted. This ensures continuous improvement effort as long as prices are manageable.

Linking carbon pricing systems across different jurisdictions

Linking carbon pricing systems can deliver greater reductions at lower prices. It makes most sense between programs of roughly equal rigor—allowing “excess reductions” in, say, Quebec to make up for insufficient California reductions.

Climate change is a global problem, so more places taking more action is a desired outcome, and linking cap-and-trade programs expands the boundary to find the lowest-cost solutions. Other benefits of linking include creating a “race to the top” by having a state like California set stringent requirements for other jurisdictions’ programs as the “price of admission” to link; enabling leaders to coordinate action, which counters notions of unilateral attempts to solve a global problem; and enabling smaller jurisdictions to access a market large and liquid enough to make it worth having a program (i.e., without linking, the jurisdiction would not adopt its own carbon limit).

However, linked carbon cap programs are only as strong as their weakest link, so policymakers should still exercise caution when evaluating whether to link with other regions. Linking will lower the price of permits and will reduce the demand signal that may be needed to successfully bring new, low-carbon technologies to the market. Where there are meaningful differences in environmental stringency, linking does not make sense. Additionally, setting up a program with multiple jurisdictions can increase the challenges of effective governance.

Decision making is also more challenging. The timing and priorities of political decisions in different jurisdictions will always vary, so moving from one target to the next in linked systems is fraught with uncertainty. One way around this is to set an improvement rate (e.g., 4% reduction in allowances per year) rather than a specified numerical target some years hence.

Carbon offsets: If an offset program is established, include strict protocols and independent third-party verification

Offsets allow industry to comply with a cap by investing in emission-reducing projects outside the covered region. For example, a cement manufacturer in California might choose to invest in a reforestation project in Colorado as a way to meet its carbon cap requirement, thus offsetting required emission reductions.

Offsets can help moderate allowance prices by expanding the reach of carbon pricing policy to projects in sectors that are difficult to directly and completely cover under cap-and-trade, such as agricultural emissions, carbon sequestration, and non-CO2 gases. Building a serious and effective carbon offset program is complex, and it should be approached incrementally and carefully. To ensure environmental integrity, it is essential to apply strict protocols and independent third-party verification, each reviewed and approved by a public oversight body.

Third-party verifiers should be assigned to projects and paid out of a pool of funds collected from project developers. Verifiers should not be chosen by developers, to avoid creating a dependent relationship, as has been observed in some projects. No offset system has yet been set up with such a strong, independent verification system. A second-best approach is to require periodic rotation of project verifiers and assumption by buyers of the liability, should verification result in offsets being ruled invalid.

An offset program should provide a list of preapproved project types but also allow bottom-up development of new protocols, which can be reviewed, refined, and approved by the supervisory body. Offset options must be periodically reassessed by an expert body to judge whether the project type or technology performance has become common practice and therefore is no longer “additional.” A sectoral approach to offsets, where evaluation occurs on a sectoral rather than a project basis, is a promising approach for reducing transaction costs while increasing environmental integrity.

Pros and Cons of Each Approach

Carbon taxes and caps share some strengths and weaknesses: They are equally effective at broad, multi-sector coverage. Either can provide long-term certainty and opportunities for continuous improvement. The point of regulation for the tax or the allowance can be the same as well.

Creating a hybrid program reduces the amount of uncertainty in either prices or emission reductions. Innovative design can further increase similarities. For example, although offsets have traditionally been part of carbon cap programs, some innovative carbon tax programs have allowed the use of offsets.

This section compares carbon taxes to carbon caps without any hybrid adjustments.

Pros and cons of a carbon tax vs. a cap-and-trade program

| Metric | Carbon Tax | Cap-and-Trade program | Best Option |

| Environmental Effectiveness | May result in higher emissions than intended | Provides greater emissions certainty | Cap-and-Trade |

| Economic Efficiency | Predictable prices support investment and minimizes economic disruption. | Less predictable prices are worse for economic performance. | Carbon Tax |

| Fairness | Higher efficiency improves socioeconomic equity

|

With more predictable emissions, better for intergenerational equity and environmental justice concerns | Situationally Dependent |

| Driving Technology Innovation | Price stability provides market certainty and encourages investment | Cap can allow higher stringency and resulting carbon price, which could drive more innovation | Situationally Dependent |

| Linking to Other Regions | Political economy hurdles have limited carbon tax linkage. | Frequently linked with other regions through cooperative agreements among jurisdictions | Cap-and-Trade |

| Simplicity | Simple to implement | Permit system and allocations can be complex | Carbon Tax |

Environmental Effectiveness

Because they are designed to achieve a specific emission target, carbon caps are generally more effective at reducing emissions to meet a specific target. A carbon cap offers a particular advantage for policymakers looking to develop plans to hit a particular emission reduction target, such as those embedded in many of the international commitments associated with the Paris Agreement on climate change.

Efficiency

Price uncertainty can inhibit both investments in new clean tech ventures and the incumbent fossil fuel combusting industry. Because a carbon price eliminates price uncertainty, it can provide superior economic efficiency.

Fairness

The fairness of impacts, environmental and socioeconomic, will depend largely on design details, with revenue use being a crucial determinant.

Simplicity

In practice, carbon caps are more complicated to implement than carbon taxes. Often, the increased complexity of a carbon cap is caused by the need to determine rules for some free allocation of allowances to energy-intensive, trade-exposed industries. Typically, carbon tax policies have handled the concerns of these industries by allowing them not to pay the tax. Similarly, the inclusion of offsets under a carbon cap can significantly increase its complexity. With full auctioning and no offsets, cap-and-trade is similarly complicated to a carbon tax.

Case Studies

Global Overview

The most obvious pitfall in pricing carbon, worldwide, has been inadequate ambition in setting targets for emission reductions. In the effort to find the balance between environmental stringency and cost containment, policymakers have leaned toward keeping costs low. The social cost of carbon, representing the damage caused by carbon emissions, can be thought of as a reasonable target price.

In practice, very few carbon pricing efforts have even approached, much less surpassed, the social cost of carbon. This is not due only to policy challenges, of course: A fortunate side note in carbon pricing programs is that it has been very cheap to hit targets.

For many years, the notion of any carbon pricing at all seemed like a pipe dream. In the 1990s, the elegantly named Tax Waste, Not Work and other efforts promoted the concept but with no concrete success. In 2005, the European Union’s Emissions Trading System (EU ETS) began operation, and it remains the largest system in the world, covering about 1.8 billion tons of annual carbon emissions. Not long after, in 2009, a group of northeastern U.S. states came together to form the Regional Greenhouse Gas Initiative (RGGI) to cover the region’s electric power plants. In 2007, California began planning its carbon cap program, which launched in 2013, and linked with the Canadian province of Quebec in 2014.

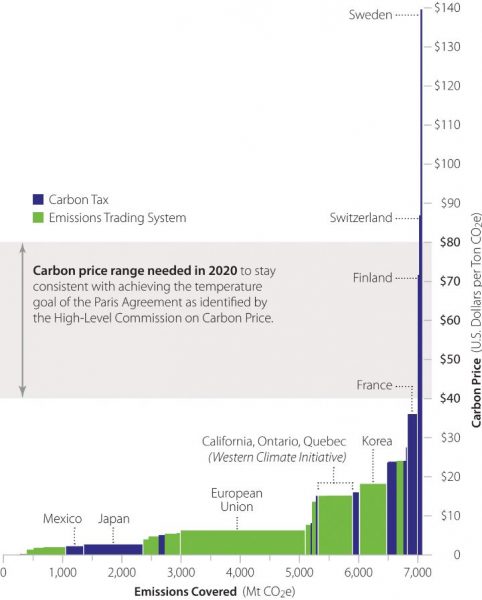

In practice, carbon prices have remained far below the levels needed to drive enough emissions reductions. Source: World Bank.

A comprehensive survey by the World Bank finds that about 40 nations and two dozen subnational jurisdictions have established a price on carbon. These instruments currently cover about 12% of global greenhouse gas emissions. Roughly two-thirds of the coverage, about 8% of global emissions, is under a carbon cap, and about 4% is subject to a carbon tax. A particularly anticipated development is the expansion of China’s pilot projects, which should cover more than 1.2 billion tons of emissions. China’s national cap-and-trade program is expected to launch in 2018.

Aggregating all the world’s current carbon prices into a curve also shows the amount of CO2 tons covered. The width of each segment of the stairstep line shows the amount of covered emissions, and its height indicates the price. But for a tiny slice of emissions in Nordic countries, nearly the entirety of the globe’s carbon pricing falls well below the U.S. Environmental Protection Agency’s social cost of carbon, about $41 per ton. This also highlights the recommendation of the High-Level Commission on Carbon Prices that countries aim for carbon prices of $40–$80 per ton in 2020 in order to meet the emission reductions agreed to in the Paris Agreement.

Although the EU ETS has become an accepted part of doing business in Europe, it stands as a cautionary tale about the potential for a very large bank of allowances to accumulate and cause persistently low allowance prices (the program has no auction price floor). The price has varied from €3 to €10 since 2011, standing at €7 per European Union Allowance as of October 2017.

The onset of the financial crisis in late 2008 caused a fall in emissions due to reduced economic activity. Other renewable energy and energy efficiency policies also drove emissions down. The result was an oversupply of allowances that reached more than 2 billion tons in 2013, at the start of the program’s third compliance period. Policymakers are tackling the problem by taking some allowances out of future caps and delaying some auctions. Meanwhile, political barriers have impeded adoption of a price floor.

Carbon taxes have been most robustly used in Nordic countries, where prices range from about $25 per ton in Denmark to roughly $50 per ton in Norway and Finland and $130 per ton in Sweden. These Nordic countries have mostly used new government revenue to lower taxes on labor. Japan greatly expanded the emissions covered by a carbon tax when it introduced one in 2012, but at less than $2 per ton it provides a weak incentive. Canada’s new commitments around carbon pricing should be a game changer in stringency for taxes, with a carbon price of $10 in 2018 and increasing to $50 in 2022.

Regional Greenhouse Gas Initiative linked carbon cap program

RGGI covers the electricity sector CO2 emissions in nine eastern American states. A key highlight is the program’s early embrace of auctioning as the main method of distributing allowances. RGGI was the first program to fully auction allowances, illustrating the economic benefits that can be created by smart investment of auction revenue.

Revenue generated by RGGI has funded energy efficiency improvements, which have created an array of economic benefits, starting with consumer savings of more than $618 million, and spending of extra disposable income from energy efficiency and local clean energy investments has generated more than $2.9 billion in additional economic growth. Public health benefits worth $5.7 billion are estimated to have come from reductions in fine particles and smog-causing emission, which are co-benefits of lowered carbon emissions.

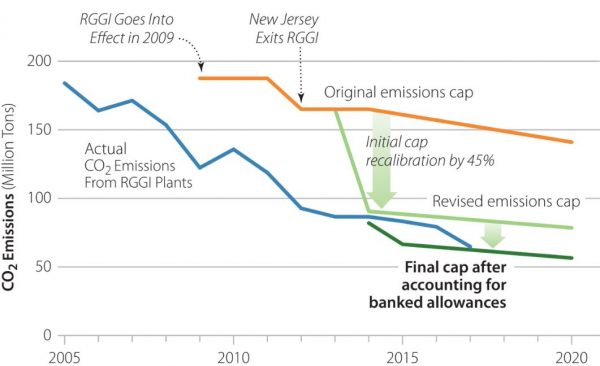

Time and again, modeling in advance of cap setting has resulted in business- as-usual emissions that are higher than the real-world result, and RGGI is an example of the problems with using this approach. As a result of basing allowances on a forecasted emission scenario, RGGI has wrestled with over-allocation. Despite the governance challenges in a linked system, RGGI has been regularly tightened to deal with this oversupply. In addition to the cap adjustments discussed later, RGGI has established a regular four-year program review and recalibration process.

In 2005, when the cap was set, natural gas prices were high and rising, as were emissions. The intent of the states was to set the cap at the expected levels in 2009, keep it flat for five years (when emissions were otherwise expected to continue to grow), and then decrease it by 2% per year through 2019. It was a surprise when gas prices fell precipitously in the intervening years, displacing a great deal of coal and causing emissions to fall far below the cap before the program had even launched.

The Regional Greenhouse Gas Initiative has adjusted cap levels downward in response to new information about program performance. Source: U.S. Energy Information Administration.

RGGI was more than 50 million tons oversupplied from the outset. By 2012, emissions had fallen to about 90 million tons, about half the level of the 180-million-ton cap. Participating states made two adjustments to the cap in response to the oversupply of permits. First, they lowered the cap to account for the misjudgment of underlying technological trends; modelers had not anticipated the decline of coal with the emergence of natural gas as a cheaper alternative. In a second adjustment, the states lowered caps by 140 million tons to account for excess allowances sold and banked from 2009 to 2013.

In 2017, the program completed another review, tightening the post-2020 cap, which had previously been set to flatten. Under new commitments, the cap will provide an additional 30% reduction in emissions by the year 2030 relative to 2020 levels. As part of this adjustment, the Regional Greenhouse Gas Initiative will also undertake another adjustment for banking.

The price floor included in the initiative has saved the program’s allowance price from completely collapsing. By 2017, the price floor had reached $2.15 per ton, with an escalation rate of 2.5% per year. Thus, the price floor ensured the program provided some revenue, although it did not truly solve the problem of over-allocation. At such low prices, it costs little to purchase allowances as a hedge against future higher prices.

RGGI includes a soft price ceiling by allowing a set of reserved allowances to be released if the price hits certain levels: $4 in 2014, $6 in 2015, $8 in 2016, and $10 in 2017, rising by 2.5% each year thereafter. Prices have remained low, however, peaking at $7.50 per ton at the December 2015 auction. However, in light of the low soft price ceiling, some release of reserve allowances has happened.

In sum, RGGI demonstrates how policymakers can adapt to oversupply, why auctioning of allowances is important, and the value of having a price floor at auction. However, the program suffers from limited coverage (it covers only the power sector), failure to address leakage (it does not cover imported electricity), and an overly weak price collar.

California-Quebec-Ontario linked carbon cap program

The California–Quebec–Ontario linked cap-and-trade program is the best example of cap-and-trade design. The California and Quebec programs launched separately in 2013 and joined together in 2014. Linkage with Ontario was agreed to in 2017 and took place in 2018. California is the largest emitter among the three, with 62% of emissions, compared with 26% for Ontario and 12% for Quebec.

The program has the widest coverage of any large carbon cap, covering about 80% of emissions across the entire economy and almost all fossil fuel combustion. The program accounts for imported electricity, reducing the problem of electricity generation shifting outside the program’s borders to avoid the carbon price. Program design is mostly aligned among the jurisdictions, although some differences exist.

The program’s most outstanding feature is its price collar. The California price collar started at $10–$40 per ton, and it increases annually at a rate of 5% plus the rate of inflation. In 2017, the price collar range was $13.57– $50.70 per ton. This price collar is the highest of any carbon cap.

California has mostly auctioned allowances rather than giving them away in order to prevent windfall profits. In an interesting hybrid allocation approach, state electric utilities receive free allowances but are required to sell them at state auctions in what is called a “consignment auction” approach. The revenue is sent back to privately owned utilities with stipulations. Funds are returned as a lump sum payment per customer, which has the effect of counteracting price increases while also retaining a carbon price signal.

California’s design is not without potential for improvement. The California case offers another example of how difficult it has been to achieve sufficient stringency. The program’s emissions have fallen below cap levels because of a combination of the success of other policies in driving down emissions and the recession of 2009–2010, leaving emissions lower than originally expected. As a result, the state’s 2020 target is turning out to be easier and cheaper to meet than expected.

The carbon cap is successfully playing the role it was given in the context of the package of policies put in place to achieve the 2020 target. That package of policies relied primarily on performance standards and other sector policies. Before implementation, cap-and-trade was expected to deliver only about 20% of reductions. In reality, cap-and-trade has driven less than that, but this is not a problem because it was always intended as a backstop.

However, oversupply in the system, if left unaddressed, threatens to undermine the effectiveness of the carbon cap, a significant problem because California is increasingly relying on it as the linchpin of its climate policy efforts.

Oversupply and banking at this level could significantly reduce the future effectiveness of the carbon cap. California’s 2030 strategy envisions the carbon cap delivering 40–50% of emission reductions from 2021 to 2030, in the range of 240–300 million metric tons. Eventually, the program will need to confront oversupply, probably as RGGI did, with future caps adjusted downward to account for banked allowances from oversupply in its first years.

In sum, the California–Quebec–Ontario cap-and-trade system is exceptional for its broad coverage, high price floor, and consignment auction innovation. However, as with other carbon caps, oversupply is a serious concern.

Conclusion

Carbon pricing is not a silver bullet to achieve the deep emission reductions needed to meet the two-degree target. Rather, it is one important part of a package of policies such as those outlined in this book.

The steadily increasing adoption of carbon pricing attests to the positive real-world experience so far. There have been no major breakdowns or market disruptions that might have led to a loss of confidence in the approach. The policy has proven to be an attractive source of revenue. Economists and public finance experts universally agree there are efficiencies to raising funds through charges on pollution or other socially harmful activities. For regulators, carbon pricing has somewhat lower informational demands, providing a cross-sector tool to achieve cost-effective reductions above and beyond other policies.

The major limitation so far is that policymakers have been overly cautious. Taxes have been too modest and caps too generous, evidence of the substantial political hurdles and the limits of state-of-the-art economic and technology forecasting. Our suggestion to focus on proper design instead of whether to use a tax or a cap aims to move the dialogue past clashes of worldviews to practical design considerations.

Design of either can be simple or complex, and they have similar enforcement requirements. Each can be structured to counter its weakness through hybridization. Carbon pricing policy should embody scientifically grounded emission targets while using proven mechanisms to keep prices within reasonable bounds. If chosen, carbon taxes should be quantity-adjusted, with prices ratcheting up if emission impacts fail to materialize as expected.