Complementary Power Sector Policies

Potential emissions reductions from complementary electricity sector policies.

Though pushing more zero-carbon resources onto the grid through policies like renewable portfolio standards and feed-in tariffs is an essential part of decarbonizing the power sector, these policies are not likely to be sufficient. As the share of renewables increases, the grid must become more flexible, and policies increasing this flexibility become necessary. These complementary power sector policies can accelerate the power sector transformation and contribute at least 11% percent of the global emission reductions necessary to meet the two-degree Celsius target.

Power grids often have significant available but unused grid flexibility, so policies encouraging existing resources to be used more flexibly are one option. Investment in new infrastructure like demand response, storage, or fast-ramping generation is another option to increase grid flexibility.

But as more zero-carbon resources are added to the grid, fossil fuel power plants must be retired and removed. Well-designed performance-based regulation can align utility decision making and encourage retirement of these units. Innovative financial instruments, such as re-financing, can also make early retirement of fossil fuel resources attractive for utilities.

Finally, reducing the risk (de-risking) of investment in renewable energy projects is a critically important step with three major components: technology risk, development risk and pricing risk. Addressing each of these risk profiles helps investors—utilities, banks or other institutions, find the necessary will to invest in renewable projects.

Policy Description and Goal

A more holistic plan will require energy policies beyond FITs and RPS. Other changes to the power sector can accelerate RPS and FITs and enable further emission reductions. The most important among these are policies promoting grid flexibility, performance-based regulation (PBR), well-functioning competitive power markets, policies facilitating orderly retirements of existing power plants, and investment- grade policy design that de-risks renewable energy projects.

These policies together can help accelerate the power sector transformation and deliver at least 11% of the reductions needed to meet the two-degree target.

The goal of the policies described in this chapter is to support the institutional and physical system needed for clean electricity to thrive at low cost and high reliability. To achieve this goal, policymakers can focus on five areas of activity:

- Supporting the many sources of flexibility on the grid

- Using PBR to align utility financial incentives with a clean system

- Designing and operating competitive power markets well

- Providing for orderly retirements of outdated power plants

- De-risking renewable energy development with investment-grade policy

Grid Flexibility

A decarbonized power system will necessarily eliminate coal (at least without carbon capture and sequestration, which today remains quite expensive) and greatly reduce natural gas generation. Nuclear may remain a part of the decarbonized generation mix, but today’s costs are quite high compared with those of other zero-carbon power plants. Solar and wind power are cheap options today, but their production varies with the availability of sunlight and wind, so they require a more flexible power system to realize their value as power system decarbonizers.

The electric grid has always been somewhat flexible in order to meet variable electricity demand in every instant. Fortunately, many options are already available to draw flexibility out of the power system. Grid flexibility can come from physical assets, such as batteries and fast-ramping natural gas plants, or it can come from improved operations, such as using advanced information technology to better co-optimize power supply and power demand.

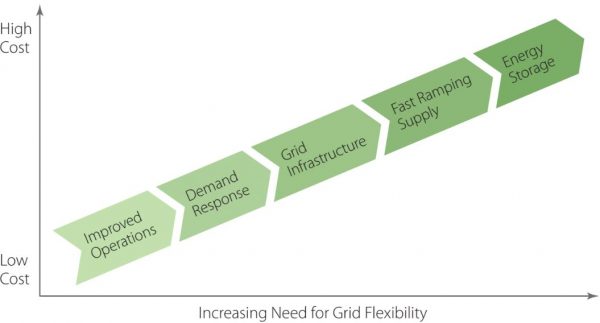

The cheapest option is to improve grid operations to draw out latent flexibility in the existing system. This includes shortening the amount of time between each grid rebalancing and dispatch, incorporating better real-time weather forecasting into grid operations, and expanding the geographic area over which grid operators keep the system in balance if there is already transmission capacity available (to take advantage of a more diverse portfolio of resources).

Illustrative costs of grid flexibility options. Source: National Renewable Energy Laboratory.

Demand response is the next cheapest option. This refers to a suite of approaches to differentiate, categorize, and aggregate electricity demand in order to shift it away from times when supply is scarce to times when supply is in surplus. For example, switches and radios can turn every building into a thermal battery; by precooling or preheating buildings and water supplies, thermostats and water heaters become amazing sources of grid flexibility while delivering the same comfort and service to building occupants.

After demand response comes grid infrastructure. Improved transmission and distribution infrastructure can also increase grid flexibility. Increased transmission capacity allows electricity to be transported more readily within a balancing area, meaning that more of an area’s resources can be used to help balance supply and demand.

Similarly, increased transmission capacity connecting balancing areas means that operators in different regions can buy and sell electricity from each other. This allows operators to draw on the resources of multiple regions to balance out variability and similarly allows operators to import electricity when local prices are high or export electricity when there is a surplus and prices are low.

Distribution system infrastructure also helps balance out supply and demand, similar to investments on the transmission system. For example, updating infrastructure to enable a two-way flow of electricity (rather than the traditional one-way flow from big power plants to customers) creates an opportunity for distributed energy such as rooftop solar or batteries located in buildings to serve more than just on-site energy needs.

Next, in terms of cost-effectiveness, is fast-ramping generation. Combined-cycle natural gas plants can provide this service, as can some hydroelectric generators, if environmental constraints are met and plants are properly compensated. And finally, storage can tackle grid flexibility needs. The cost of battery storage decreased more than 80% from 2011 to 2017 and has even begun to win out on costs in certain all-source (cross-technology) bids for flexible resources.

More sources of flexibility will probably emerge as the global power system transitions. Policymakers should look for creative opportunities to improve grid operations, draw out demand response, build necessary transmission and undertake important distribution system upgrades, support power plants to operate flexibly when they can, and facilitate deployment of energy storage.

Performance-Based Regulation

Some aspects of electricity delivery are natural monopolies. For example, it does not make sense to build multiple sets of wires to every building. So unless the government directly owns utility infrastructure in a region, regulation of private monopoly utilities will always be a part of electricity policy. In many parts of the world, private monopoly utilities have traditionally been regulated under a “cost of service” model, which allows utilities to earn a rate of return on all capital investments and to pass through most operational expenses to customers. This structure works well when the goal is power system expansion, but it creates a bias for utility-owned, capital-intensive infrastructure.

To tackle these biases and align utility financial incentives in pursuit of important societal outcomes, several regions have adopted PBR, and this regulatory structure is providing new opportunities for innovation in the utility sector. PBR shifts some of the utility’s profit incentives toward achievement of top goals.

For example, regulators could offer utilities cash or extra basis points on the rate of return if they meet quantitative targets for things such as CO2 per capita, and similarly, regulators could assess penalties for failure to reach important targets. Regulators can use this kind of mechanism to shift an appropriate amount of risk onto the utility for meeting important societal goals, enabling them to use their role as market makers to drive outcomes in the public interest.

PBR can (and should) be designed with customer affordability in mind. For example, regulators can limit a utility’s revenue— called a revenue cap—in order to encourage them to behave more efficiently and keep costs low. Over time, the cap can be adjusted to account for changes in the productivity of the utility.

This structure contains costs and makes utilities most profitable when they serve as a platform for customers to access clean energy and demand management services. As former utility regulators Ron Binz and Ron Lehr say, PBR shifts the central question from “Did I pay the right amount for what I got?” to “Am I paying for what I want?”

A well-developed area of performance ripe for measuring and compensating utilities is energy efficiency. Efficiency investments counteract traditional utility regulation because efficiency reduces sales and can avoid the need to expand capital investment by reducing wear and system peak. Because distribution utilities also handle retail sales in most places, they generally have sufficient data to identify customers who could benefit from efficiency investments based on their usage, but they would prefer not to encourage behavior changes or customer investments that reduce their profits.

In the U.S., it is becoming common to remedy this conflict by providing financial incentives to utilities for achieving greater efficiency via direct investment, customer education, and connecting efficiency vendors to customers. 27 U.S. state-level programs have resulted in increased spending on efficiency and cost-effective emission reductions.

A financial structure that pays utilities for outcomes can set the table for innovation in a historically staid industry. Well-designed PBR aligns utility decision making to accomplish a clearly defined goal, opening up opportunities to innovate and integrate new technologies.

Well-Functioning Competitive Power Markets

Competition has moved—at varying paces in different parts of the world— into electricity generation, transmission, and demand. Many countries have introduced competitive generation, with market regulators setting rules for wholesale clearinghouses in which generators compete. Some areas have also introduced competitive transmission, wherein independent transmission companies may compete to build and operate transmission lines, taking bids and negotiating contracts to move electricity. Some have adopted retail choice, where residential and small business customers can choose their own power supplier.

As a rule, a system optimizer—often known as a regional transmission organization—is needed to facilitate competition in a region. Regional transmission organizations direct traffic on the high-voltage transmission system by dispatching power plants in a fair, reliable, and economically efficient manner. They do so by providing a neutral platform for wholesale transactions, facilitating competition between generators, transmission, and other resource providers, protecting against market power, and prioritizing the dispatch of least-cost resources.

Well-managed competitive markets have the potential to lower prices, drive innovation, serve customers well, and reduce emissions. But it is tricky to design markets that cover all the near- and long-term system needs, so regulators need to act with care and sophistication to ensure markets are set up well to meet clean energy goals while balancing economic efficiency with reliability. It also may be beyond the power of electricity market operators to price some externalities, particularly environmental ones. This raises the importance of promoting a technology-neutral market while using other mechanisms, such as a carbon tax or cap, to value greenhouse gas mitigation.

The interface between transmission and distribution grids demands special care, if resources at the distribution scale are to provide their full value to the integrated grid. This can provide a great opportunity for low-cost, clean grid services, but capturing that opportunity presents two challenges. The first involves creating rules for these distributed resources to participate in large-scale competitive markets. The second involves operational coordination between the bulk system and distribution system, which do not currently communicate with one another on a technical and operational level.

To adapt to the changing resource mix, competitive power markets must update their rules and product definitions to expose the value of grid flexibility latent in today’s power system. In particular, the service of shifting supply and demand from periods of excess to shortage periods will be particularly valuable. This includes flexibility on fast timescales to deal with short-term variations in wind and solar production as well as longer-term, more predictable fluctuations caused by sunset or seasonal wind patterns. Regulators can also begin to think about the long-term changes that will be required if the power system is to operate cost-effectively with a high share of low- or zero-marginal-cost resources.

Orderly Retirements

As power system infrastructure turns over to become cleaner and more resilient, regulators must create a supportive environment for orderly and timely retirements of polluting power plants. In vertically integrated regions, the choices utilities and their regulators make about these retirements can have important implications for customer affordability.

Analysis by the Climate Policy Initiative in the U.S. finds about half of the nation’s coal plants are uneconomic on a marginal cost basis compared with the all-in capital and operational costs of a new wind facility in a nearby region. But investment inertia is keeping many of these plants operating nevertheless. In regions where generation is owned by regulated utilities, allowing utilities to sell the remaining undepreciated balance of an old, uneconomical power plant to a bond-holder can enable the utility to recycle that capital into more productive, cleaner alternatives at a savings to customers.

In regions with competitive generation, policymakers can support reasonable retirements by holding firm on market rules and products that maintain a level playing field, avoiding changes requested by owners of power plants that can no longer compete. A well-functioning competitive power market will send the appropriate price signals to keep the system in equilibrium as old plants retire.

Investment-Grade Policy: De-Risking Renewable Energy Projects

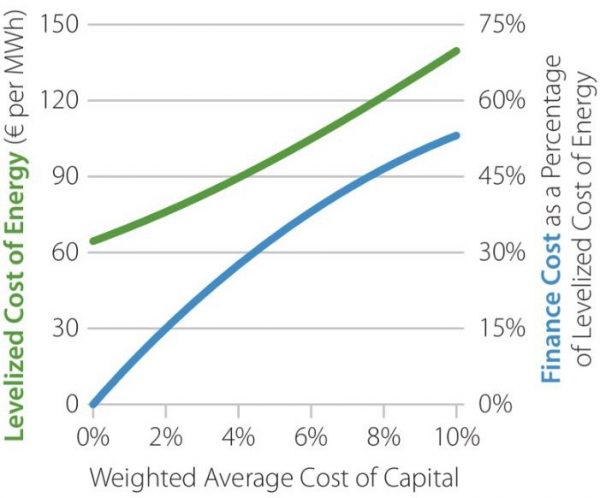

Renewable energy technologies have high initial costs but then cost very little to operate, because they do not require fuel. One consequence of this capital-intensive nature is that renewable energy is very sensitive to the cost of capital, that is, the interest rates or return rates demanded by those who lend or pay for renewable energy technology up front. For example, high interest rates can significantly increase the overall cost of a wind farm.

Lower financing costs can reduce the costs to build new energy technologies. Source: BVG Associates.

Return requirements and interest rates, in turn, are driven by risk. Investors properly demand higher returns when they face higher risks. So, if smart public policy can drive down risk, it can drive down cost. And the difference can be dramatic, cutting overall costs by close to 50% in some cases.

Risk comes in many flavors: Technology can fail, it can be difficult to site a wind farm, construction may be delayed because of permit problems, and the sale price of electricity might be unknown. Most of these risks can be mitigated by smart public policy, without compromising key public values. And where that is done, clean energy becomes cheaper.

The first of these risks, technology risk, is substantially reduced for solar PV and onshore wind, which are now reliable and inexpensive, and underwritten by a wide range of equity investors and project finance lenders. Other technologies are still approaching this status in many markets, including concentrated thermal solar and offshore wind. This section focuses on clean energy technologies with low technology risk, which can nevertheless suffer from development and market uncertainty in the form of project development risk and price certainty risk.

Project Development Risk

Development risk comes in three principal forms: siting, permitting, and transmission access. Siting risk has many dimensions, such as landownership, usage terms and rights, access to roads and transmission, and environmental or cultural conflicts. Each conflict raises uncertainty—sometimes a decade’s worth—that can kill a project. If a developer has to spend two years trying to get siting questions answered, that means two years with no returns, two years of climbing expenses, two years of expiring tax breaks, and so forth. Good policy can drastically cut this uncertainty by pre-zoning land and engaging stakeholders early, while setting clear requirements and timeframes for permits.

Once a site has been selected and approved, dozens of other permitting requirements arise, including access to land, construction standards, fill issues, inspections, noise, traffic, visibility, dust, worker protection, and so forth. And these permits are usually required by many different federal, state, county, and city offices. The upshot can be a paper blizzard that adds years to a project.

A jurisdiction with a goal of deploying clean energy can clear out this sort of costly clutter by thinking ahead, setting clear standards, and then offering rapid permits for projects that meet those standards. This is not a simple process, but it can have profound risk-reducing effects.

Large-scale solar and wind projects also need ready access to transmission lines to get their power to market. For sites without ready access, the aforementioned siting and permitting issues apply doubly to additional transmission projects. Building transmission lines that link the best, low-conflict renewable resource areas with high-demand cities makes renewable penetration faster and cheaper. Texas illustrated this beautifully when it established Competitive Renewable Energy Zones (described in a case study later on in this section), which was a planned strategy to build a suite of transmission lines connecting the windiest areas of Texas with load centers.

But even where access is available, it can be inhibited by overly complex interconnection standards, which in some jurisdictions seem designed to keep competitors out. The way around this is to have clear, straightforward interconnections and procedures, with reasonable time limits, for handling permits, and to apply nondiscriminatory standards.

Some helpful design points for the interconnection process include reasonable but conservative screening to ensure an interconnection queue isn’t crowded with projects that will not be built, a queue that prioritizes contracted projects over uncontracted projects for the same reason, a study process that allocates costs fairly among all projects in a given cluster, and a principle that upgrades cannot be added outside the official process and can be added only at specified times within the process.

Selling the Power – Price Certainty Risk

The next major realm of uncertainty in developing a big renewable energy project is the price of the electricity generated. A long-term, highly certain price from a reliable purchaser makes it far easier to both invest capital at lower discount rates and raise competitive project financing. More generally, long-term power contracts also allow non-recourse financing, which allows developers that don’t have a large balance sheet to compete with those that do.

Utility-scale energy supplies have different sales conditions depending on the regulatory system in which they operate, and there is quite a range. Traditional vertically integrated monopolies—which own the power plants and transmission and distribution systems and sell directly to customers—can build their own power plants, or the utility may be the market maker, signing power purchase agreements with independent power producers.

At the other end of the extreme lie competitive power markets where electricity is sold in five-minute increments, with the help of a day-ahead auction. Both of these market structures are possible simultaneously because deregulated retail utilities sign contracts with different vendors to hedge and reduce risk. In California, projects can have long-term contracts but participate in the day-ahead or real-time market with a portion of the power plant output that is not contracted.

Clearly, a certain long-term price is more likely with a power contract than with a daily auction, but even in competitive power markets, bilateral contracting can lock up prices for a long while.

The ingredients of smart pricing are:

- For a vertically integrated monopoly building its own power plants, the regulator should allow a 10- to 20-year cost recovery schedule—but should certainly benchmark the price against those offered in competitive markets, so consumers do not overpay.

- For jurisdictions with the utility or the regulator as a market maker, offering solicitations to independent companies to build a new power plant, the regulator should offer 10- to 15-year contracts to bidders.

- For day-ahead and real-time competitive energy markets, the system should be structured to encourage a healthy volume of long-term bilateral contracts between energy marketers and energy suppliers.

In all cases, public incentives for clean energy should align with the time- scales needed for smart development (i.e., at least 10 years). Designing incentives over a long time horizon also helps avoid uncertainty about whether subsidies will be renewed, which can happen with subsidies that span only a few years at a time.

When to Apply These Policies

Regions around the world are undoubtedly in different stages of the move to clean electricity. Context is very important for these policies. What does the current electricity mix look like? What power generation resources are available in the region, and how do their costs compare? The answer to these first questions can help sort which options for grid flexibility may be appropriate for the region.

Are regulated utilities, the government, or competitive providers the primary providers of electricity? The answer to this question can enable policymakers to dig deeper into PBR or well-functioning competitive power markets.

Are all customers receiving adequate electricity service, or does the system need to expand to provide access to electricity for everyone? And is overall demand for electricity growing, staying steady, or falling? The answers to these last questions have a serious impact on which of these policies to prioritize and how, so this question is covered in more detail in the following sections.

Economies with Flat or Declining Electricity Demand

Flat or even declining electricity demand is increasingly common in developed countries. This is due in large part to major progress on energy efficiency policies and improving technologies, such as light-emitting diodes, which have resulted in a decoupling of economic growth from growth in energy demand. In regions with flat or declining electricity demand, all four mechanisms described earlier are important (support for grid flexibility, PBR, well-functioning competitive power markets, and orderly retirements), but orderly retirements may be especially important.

Electricity systems that historically relied on coal, oil, or natural gas will need to see retirements in order to make room for zero-carbon power. This fact creates losers among power generators, which may have unpaid capital balances left on their investments. Because of the dominant role of fossil-fueled power in the past, early retirement of these plants is likely to require new approaches to running the grid, and the changes will prompt calls for support for fossil-based resources.

Policymakers should objectively assess whether adequate clean replacement generation, coupled with cost-effective efficiency. Storage, and demand response, is available to keep the lights on as old power plants retire. If so, power sector regulators should continue guiding smart retirements and replacements while finding ways to support workers as they transition from old industries.

Economies with Growing Electricity Demand

Regions may see electricity demand growth for several reasons: Perhaps the overall population is growing, energy-intensive industries are growing, more people are emerging from poverty and able to afford electricity, or perhaps electric vehicles are experiencing substantial growth. Whatever the source, regions with consistent electricity demand growth should look seriously at strong RPS or FITs, as well as all four mechanisms described in this chapter.

Growing demand can signal macroeconomic trends, but it can also signal opportunities to improve energy efficiency and warrant higher standards for buildings and industry. Efficiency investments are usually the most cost- effective zero-carbon resource to meet growing demand, and economies with growing electricity demand should closely examine performance standards such as energy efficiency resource portfolios and efficiency incentives for their utilities.

Of course, orderly retirements will be less of a focus in a high-growth environment, but it is nevertheless a sign of a healthy power sector when clean generation sources begin to replace older, polluting power plants at the same or lower cost for customers. Orderly retirements may still be proper when existing resources are dirtier and more expensive to run than new clean energy replacements, as long as sufficient financing is available to both meet growing demand and replace old generators.

Economies without Universal Access

Deploying and maintaining electricity infrastructure is a major challenge for developing economies that have not yet achieved universal electricity access for their citizens. Expanding access by connecting customers to the existing grid often requires building massive distribution and transmission infrastructure projects, necessitating large amounts of capital that may not be readily available.

High upfront costs coupled with potentially low returns from customers who may have trouble paying their bills consistently can undermine the ability to attract capital for infrastructure buildout, often necessitating some level of state support. Even where grid connections have been established, reliability of service can be low, undermining the perceived value of grid expansion in a vicious cycle.

Many off-grid households rely on smaller, distributed fuel-based methods of generating power or heat, such as diesel generators or burning coal, oil, or animal dung to cook, light, or heat buildings, but those are heavy polluters, harming community health. Fortunately, technological developments have enabled new options for clean electricity, many of which can actually save customers money relative to fuel-based alternatives.

With technology costs declining, novel options for energy access are emerging, ranging from super-efficient solar home systems to community microgrids. Off-grid or community-based shared solar and battery arrangements provide access to electricity at a lower cost and can be deployed more nimbly than grid infrastructure extension in many cases. The Sierra Club estimates that rural access to energy via solar-powered minigrids will cost about $250 per customer, whereas grid extension costs about $1,000–$2,500 per customer, depending on the distance from the existing grid.

In the context of providing electricity access, policies should focus on mobilizing capital and building institutions to enable access rather than refining large institutions through the changes to utility regulation and wholesale market rules described earlier. Some of the Sierra Club’s principles to expand access to clean electricity in off-grid systems are particularly salient:

- Support deployment and development of highly efficient appliances and agricultural equipment

- Focus on providing small solar and wires investments that provide basic access, then build financing support as markets mature and incomes increase to pay for more services

- Reduce costs of access by eliminating private investment risk through loan guarantees or rural feed-in tariff subsidies that guarantee cost recovery

- Define utility regulations in the off-grid and mini-grid space

Detailed Design Recommendations

Several policy design principles apply to policies that facilitate a low-cost transition to renewable energy in the electricity sector.

Create a Long-Term Goal and Provide Business Certainty

PBR works best when performance targets are stable and extend well into the future. Investor-owned utilities are viewed as low-risk enterprises that are able to pass on the benefits of low-cost capital to their customers (low risk is ultimately reflected in lower electricity prices). Under cost-of-service regulation, most of the risk to utility investors is due to regulatory uncertainty—regulators who have approved capital investments at one time may change, increasing the chance that the utility will not be allowed to collect the full cost of its investment in the future. Subjecting a portion of utility returns to PBR introduces additional risk when there is a lack of certainty as to whether the utility can meet regulation targets. However, performance-based incentives should have upside as well, creating opportunities to increase returns and offset higher risks.

Any change to the utility compensation model creates some uncertainty, but this can be mitigated through smart policy design. The first principle should be to set performance goals over a long enough time horizon, at least five but up to eight years. Longer timelines provide the business certainty needed for innovation, but targets set too far into the future can be overwhelmed by uncertainty about exogenous trends or events.

Whatever timeline regulators choose at the beginning of a program, they should not materially alter the goals until the chosen performance period is over, in order to support a stable business environment and avoid the perception of greater regulatory risk that unnecessarily raises utilities’ cost of capital. In the context of revenue cap regulation, utilities and their investors need confidence that regulators will stick to a revenue cap even if utility profits increase, maintaining the efficiency incentive.

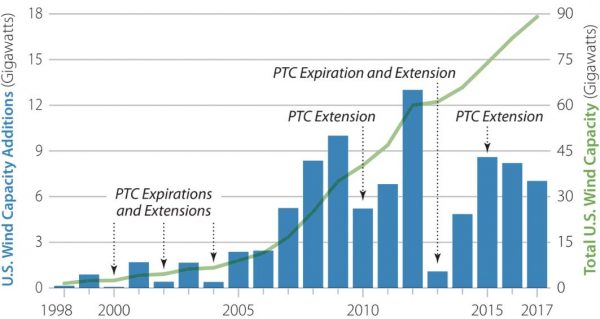

Long-term policy certainty is also crucial for de-risking renewable energy development. One example of the need for policy certainty is the U.S. production tax credit (PTC) for renewable energy. Although the PTC was fixed for 10 years, the U.S. Congress allowed it to lapse five times and delayed extension to the final days of the year in other years, causing turmoil and uncertainty in the wind industry, even driving some producers out of the market. Without certainty the that PTC would be extended, the wind industry built incredibly fast in the on years and ceased construction in the off years. This boom–bust cycle of investment is hard for companies to maintain and leads to inefficient outcomes.

Policy uncertainty creates wind energy boom and bust cycles. Source: U.S. Department of Energy.

One could be forgiven for thinking that these policies—on-again, off-again credits with limited liquidity—were designed to vex the very industry they were supposed to help.

The U.S. largely fixed this problem with the 2016 extension and gradual phase-down of renewable energy tax credits. The wind PTC phases down to zero gradually from 2017 to 2020, and the investment tax credit for solar technologies phases down incrementally from its 2017 level of 30% to 10% in 2022. A gradual phase-down, announced in advance, for technologies close to market competitiveness can also achieve a de-risking effect.

Price in the Full Value of Negative Externalities

Wholesale electricity markets send the wrong price signals when externalities are not reflected in the marginal price of generation. This is particularly true of carbon and other air pollutants that affect human health. Because centralized wholesale markets rely on the marginal price of energy to dispatch different generators in a least-cost fashion, what may appear to be cheap coal or natural gas is costing more than it appears when only direct fuel costs are considered.

In the absence of a carbon price in the region or at the fuel source, wholesale markets can consider adding a proxy social cost of carbon calculation to the bids of generators based on their carbon intensity. This will create more revenue for zero-marginal-cost resources such as wind and solar while promoting zero-emission dispatchable resources such as nuclear and hydro over their main competitors: natural gas, coal, and oil..

Eliminate Unnecessary “Soft Costs”

Lowering development risk for renewables is a key measure to reduce soft costs—the non-hardware component of a project’s costs—when building wind and solar projects. Good policy can drastically cut this uncertainty by pre-zoning land and setting clear requirements and time frames for permits.

For example, a public land agency such as the Bureau of Land Management can zone land as green, yellow, and red. Green zones would be suitable for renewable energy development as long as clear, pre-specified conditions are met. Red lands would never be developed; don’t even ask. Yellow lands would open up a complex, careful process to determine whether they are suitable for development. Today, almost everything is, de facto, yellow and vastly inefficient.

This is emphatically not an argument for relaxed environmental standards. Policymakers and communities protect viewscapes, landscapes, habitat, wetlands, streams, watersheds, and species for good reason. Instead, this pre- zoning offers an efficient way to land at the right result. The red-zoned lands would include wilderness study areas, for example. Conversely, a green zone might be an existing oil and gas field, or an interstate highway corridor, or open land that is not critical habitat.

Permitting can also be streamlined while protecting environmental standards. The first step is to enumerate the required steps a project developer must take—and to do so across all agencies that have a say in the matter, be they federal, state, or local. The work of identifying the current permit critical path should be done hand in hand with experienced developers, because they are more likely than government officials to understand the full picture.

The work should then be collated by purpose and by jurisdiction and a clearer, simpler set of requirements produced. The result should:

- Use common forms wherever possible. If colleges can use a standard application form, there is no reason that states and local agencies can’t handle overlapping requirements the same way

- Be crystal clear on what is required for a successful permit. The goals of the standards need not be relaxed, but they should not be ambiguous, and it should not be ambiguous what it takes to meet the standard. There should be clear timelines, both in terms of submission by developers and response by the permitting authority so that timeline clarity is evident. This will allow developers to appropriately raise and invest capital according to when key risks (such as binary or discretionary permit approvals) are mitigated

- Reduce or eliminate any processes that are not necessary. Ideally, build a master file system so that applicants do not need to fill out redundant information in dozens of places. Where possible, commit to a paperless workflow process

- Set a firm, quick time commitment for approval of any permit that meets all the requirements

- Commit to a reasonable response time for any issue that arises

- Good policy should be developed and shared between jurisdictions (e.g., in California, between counties) so that reasonable standards are developed and are replicable across multiple locations, meaning developers will not have to reinvent the wheel in every new jurisdiction they enter. This allows them to cost-effectively deploy resources and import best practices into more areas

A complementary government program could be to appoint an ombudsman who, with policymakers’ blessing, can help developers clear through regulatory and permitting problems.

With this process, crafted with care and published, developers would know exactly what the requirements are for developing and permitting a new solar farm. They would have much more clarity for timing, costs, selecting contractors, and so forth, which would help investors understand that this is a lower-risk project based on clear timelines and steps to approval.

Build in Continuous Improvement

PBR is effective when the performance standards set by regulators build in continuous improvement. The state of the art for electricity service is constantly evolving as technologies enable a more connected, responsive grid.

It is now possible for system operators to have visibility into the system and predict, adjust to, and avoid reliability issues in ways that were not possible just 10 years ago. Performance targets should build in continuous improvement to reflect this reality, such as by setting targets as annual improvements rather than hard numbers tied to a specific future date.

This principle goes hand in hand with creating business certainty, because the targets for performance under PBR are also linked to utility compensation. Creating performance targets with continuous improvement also creates long-term certainty that ensures businesses will have the right signals and time horizons to make strategic investments that meet public policy goals while preserving utility profitability.

Prevent Gaming via Simplicity and Avoiding Loopholes

Gaming in the utility performance context is explained in a handbook on performance incentive mechanisms that Synapse Energy Economics prepared for regulators:

Every performance incentive mechanism carries the risk that utilities will game the system or manipulate results. “Gaming” refers to a utility taking some form of shortcut in achieving a target so that the target is reached, but not in a way that was intended. For example, if a performance incentive were set that rewarded a utility for increasing a power plant’s capacity factor above a certain threshold, the utility might understandably respond by increasing its off‐system sales from that power plant, even at an economic loss. Thus the utility would be able to meet or exceed the target capacity factor, but ratepayers would be worse off.

A key in designing performance targets and incentives is to tie them as closely to outcomes as possible. For example, if the goal is to improve system efficiency, regulators might consider measuring and setting a target for peak demand reduction rather than requiring the utility to spend some fixed percentage of its budget on demand response or buy a fixed amount of storage. The utility could meet these targets without verifying that these technologies are being used to actually reduce peak demand. Instead, the metric of peak demand reduction can be measured and verified by observing the peak demand in a start year and subsequent years.

Additional Design Considerations

Regional Coordination

One of the most cost-effective ways to integrate high shares of renewable energy is to increase geographic diversity of the resources being balanced. Over larger distances, wind patterns are negatively correlated, meaning one place will be windy when the other is not. This reduces the need for backup generation and storage to even out wind’s variable production profile. Likewise, as the sun moves east to west over a continent, importing solar from the west can help manage local sunset ramps.

Bigger grid balancing areas can be achieved several ways, including merging smaller balancing areas or simply allowing trading of electricity between existing balancing areas. For example, special markets are developing in the U.S. to trade grid balancing services between regions that are operated independently from one another. Without needing to build new physical transmission capacity—simply by allowing trades between regions that did not allow them before—these burgeoning markets have saved customers in the western U.S. at least $140 million per year.

In addition, greater transmission connectivity can help increase trading capacity and increase the diversity of demand and supply options to manage variable wind and solar generation. Although transmission is expensive and difficult to site, planning renewable generation and transmission projects together can yield tremendous efficiencies.

One report that studied the U.S. grid found that the grid could run reliably and at the same cost as in 2013 on more than 50% wind and solar generation, reducing greenhouse gas emissions by 80% from 2005 levels, but this required a coordinated buildout of high-voltage direct current transmission to allow trading to access high-value renewable resources and mitigate variability.

Publicly Owned Utilities

Unlike investor-owned utilities, which are ultimately motivated by profits and shareholder value, publicly owned utilities are nonprofit entities that are owned by customers themselves, through either the state or local government or a cooperative arrangement. Publicly owned utilities are directly connected to public policy and governed democratically.

The transition to high shares of renewables is just as challenging for public utility management and boards as it is for their investor-owned utility counterparts, but publicly owned utilities may not be affected by the specific recommendations for wholesale energy market reform or PBR covered in this section.

However, some principles of PBR can be applied to encourage innovation and measure progress at publicly owned utilities. Consistently setting, measuring, and updating quantitative performance metrics, particularly around demand-side management and carbon intensity, should be a central feature of any publicly owned utility management program. For small utilities this can be a large lift, but even the simplest goals are useful places to start orienting utility operation around increasing customer value.

Publicly owned utilities are also similar to investor-owned utilities in the way in which energy efficiency can hurt their bottom line. Energy efficiency reduces the total volume of electricity sold by avoiding some demand. To recover the costs of past investments, utilities set rates based on the expected amount of electricity they will sell. If a utility then implements energy efficiency measures and lowers the amount of electricity sells, it will not recover the full costs of its past investments.

One way around this problem is to pursue revenue decoupling. Decoupling allows utilities to retroactively recover any lost revenue or return surplus revenue to customers, based on the amount of electricity sold. It therefore eliminates the incentive for utilities to sell more electricity. Publicly owned utilities worried about their revenue due to falling sales can consider decoupling as a way to reduce financial uncertainty and drive energy efficiency.

Refinancing Options for Coal Retirements

Transitioning uneconomical coal- and oil-fired power plants off utility balance sheets can be much cheaper if stakeholders take advantage of ratepayer-backed, state, or municipal bonds with very low interest rates. As explained earlier, many uneconomical plants have undepreciated balances, and early retirement would require the owners to take that balance as a loss. Moving the balance out of the utility rate of return structure and into a low-cost bond can significantly reduce the costs of paying off these old plants for customers.

The typical investor-owned utility’s authorized return—its weighted average cost of capital—reflects a mix of corporate bonds and shareholder equity. The weighted average cost of capital, in turn, depends a lot on the financial viability of the utility, its ability to collect all its costs from customers, and the investment climate and borrowing costs in the country in which it exists.

In general, the cost of equity exceeds the cost of debt, and government-backed debt costs even less than corporate debt. As a result, shifting the balance of plant costs from a utility balance sheet, where they receive the weighted average cost of capital, to one backed by a government or by customers in aggregate, can reduce financing costs, sometimes by more than 50%. This in turn makes it attractive for utilities to refinance, and ultimately retire, plants.

Case Studies

United Kingdom

The UK’s utility regulator, the Office of Gas and Electricity Markets (Ofgem), uses price controls or revenue cap regulation plus incentives to drive efficiency in regulated utilities by setting revenues for a long time and letting the companies keep a profit if they manage to deliver the same outputs at a lower cost. This program, called Revenue = Incentives + Innovation + Outputs (RIIO), is the most full-scale move toward performance-based ratemaking for utilities observed anywhere in the world to date.

At the heart of RIIO are detailed “business plans” that each utility in the UK must develop and submit to the regulator. The business plans specify the expenses each utility expects over the next eight years, forming the basis of the revenue cap. Utilities that reduce expenses below the revenue cap are able to keep about half the savings as profits, sharing the other half with customers. Utility investors also share in excess expenses as losses, producing strong incentives for cost efficiency.

To ensure a high level of service is maintained, the business plans must also be responsive to performance incentives in six primary output categories: customer satisfaction, reliability and availability, safe network services, connection terms, environmental impact, and social obligations—each with measurable targets.

Achievement of many of these targets results in higher overall profit for the utilities. Failure to meet the targets can sometimes mean a penalty for the utilities. For example, Ofgem proposed to add or subtract a maximum of half a percent of revenues based on a customer satisfaction scoring system.

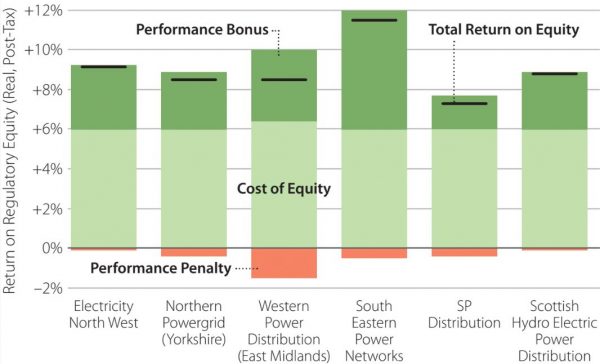

PBR can yield total returns on equity above the cost of equity. Source: Ofgem.

The dual impact of a long-term revenue cap and long-term performance incentives creates business certainty and builds in continuous improvement. All utilities were able to earn returns above their cost of capital in the first performance period, creating value for shareholders. Moreover, the utilities performed well on the metrics that were linked to performance, indicating that the incentives promoted real-world improvement.

There may have also been some performance targets that were too loose, yielding windfall profits for the utilities in the first performance period. Although some UK utilities are paying penalties for underperformance on outcomes, most are successfully earning incentives for performing well on outcomes.

This mix of penalty payments and incentive earnings is balanced, but it is worth noting that more utilities are performing (and earning) well than poorly on their outcomes. This may indicate that more ambitious performance targets could have been warranted to better share benefits between utilities and customers or that utilities were able to take advantage of information asymmetry (knowing more details about performance potential and associated cost than their regulators).

Texas

Texas houses one of seven centralized wholesale markets in the U.S., the Electric Reliability Council of Texas (ERCOT). ERCOT is unique among U.S. markets in that it operates over the footprint of a single grid, whereas the others in the U.S. operate in regions that are parts of a larger, interconnected grid. Texas’s wholesale market has several other unique features: It operates without a market for capacity, and it has a very high cap on the price of energy, at $9,000 per megawatt-hour.

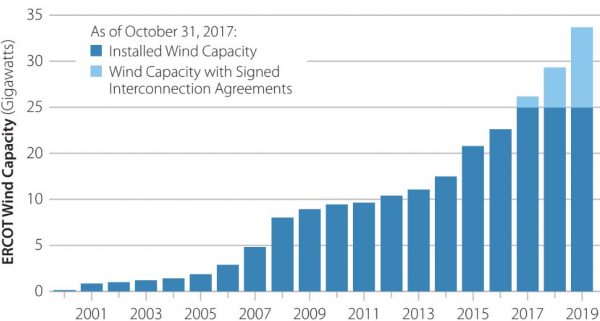

Texas has also been one of the most successful integrators of wind power, with 21,000 megawatts (MW) of capacity where peak load is 71,000 MW. In 2016, 15% of ERCOT’s generation was produced by wind power; in March 2017, a record 25.4% of total generation was from wind power. ERCOT’s policymakers have made two important recent policy decisions that have brought great benefits to their electricity consumers while driving a cleaner grid.

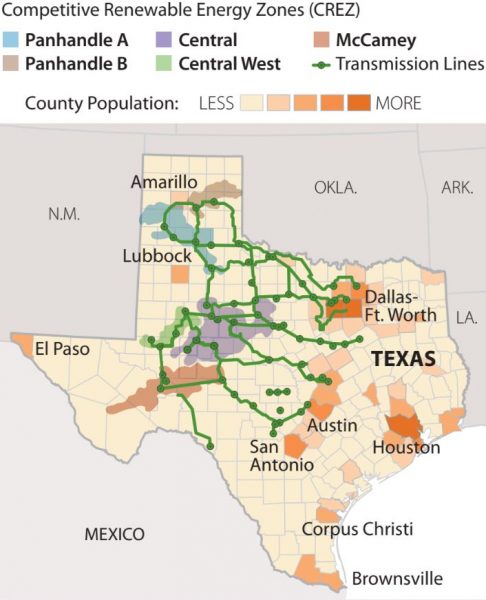

Competitive Renewable Energy Zones in Texas. Source: U.S. Energy Information Administration.

The first of these, completed in 2013, was the creation of a set of competitive renewable energy zones that funded nearly $7 billion in transmission projects to tap renewable energy resources in windy, remote west Texas.

The lines installed in these zones immediately relieved major transmission bottlenecks and gave a clear market signal to renewable energy project developers, enabling more than 20,000 MW of new wind, triple the amount of the next highest state.

The zones are technology neutral and do not require access to wind; rather, they have enabled wind resources to participate in the market.

It is anticipated that they will also stimulate at least 3,000 MW of future solar projects with complementary generation profiles to wind (which blows mostly at night in west Texas). They have also reduced soft costs for renewable developers, creating access to world-class wind resources without risk and delays created by uncertain transmission access. As a result, new low-cost wind is projected to offset the costs of the program and associated transmission lines and then some, saving customers an estimated $16 billion through 2050.

Wind capacity additions by year in Texas. Source: ERCOT.

The other important decision recently made by Texas policymakers was to forgo the use of a capacity market as a means to ensure that enough generation would always be there to serve load. Instead, Texas raised its caps on real-time energy prices and implemented a price adder that would kick in if operating reserves dropped.

By trusting a well-designed wholesale market to elicit efficient investments in the grid, Texas customers avoided costly capacity payments on the order of billions of dollars. Yet ERCOT was able to retire thousands of megawatts of inefficient old gas and coal power plants while taking advantage of record low prices for new gas and wind to enable a cleaner, cheaper, more flexible grid with record reliability. The fact that ERCOT has more than enough capacity provides evidence that a capacity market may not be necessary to provide long-term business certainty sufficient to stimulate investment in adequate power generation.

By running a very efficient, technology-neutral wholesale market, Texas has been able to reap the benefits of its RPS and investment in the transmission lines. Smart policies were able to jump-start a wind (and soon solar) market that will be delivering benefits to the citizens of Texas for years to come.

Germany

Germany has also seen major growth in renewable energy in part because of its policies to reduce the investment risk of renewable energy. Policies to reduce investment risk have reduced soft costs in Germany, provided long-term certainty, and built in continuous improvement. Of course, some of the other supporting policies described in this chapter are missing, which is part of the reason it is taking Germany a little longer than other regions to realize the emission reduction benefits of its renewables.

Financing is a large contributor to soft costs, and Germany has some of the lowest financing costs for wind and solar in the European Union. Typical financing costs are between 3.5 and 4.5% for onshore wind projects. In large part, Germany’s success in driving down financing costs results from the availability of low-cost capital from state-owned development banks. German development banks are able to provide loans at 2% or 3% interest, taking advantage of the creditworthiness of the German government. Domestic developers finance between 80% and 100% of onshore wind projects with low-cost debt, using a low share of more expensive project equity. Climate Policy Initiative estimates that between 60% and 70% of the total funding for renewable energy investment in Germany in 2013 and 2014 was originally provided by development banks.

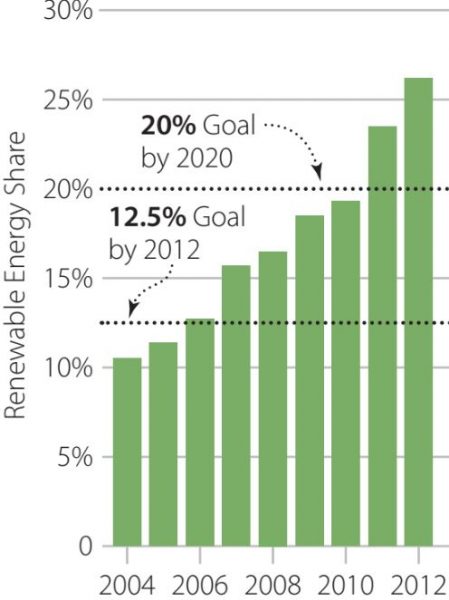

Share of renewable energy in Germany 2004-2012. Source: Fraunhofer Institute.

Long-term certainty and continuous improvement have also greatly de-risked renewable investment in Germany. FITs are structured with long-term contracts (8– 15 years) at locked-in rates, allowing investors to recover the majority of their investments with almost no risk. From 2002 to 2014, the feed-in tariff had minimal price risk, as renewable generators received fixed prices; as the market matured, this was changed in 2014 to a feed-in premium structure under which generators receive a reduced feed-in tariff on top of market-based electricity prices.

Germany’s 2004 renewable energy goal had targets of 12.5% by 2012 and 20% by 2020. That goal was increased in 2012 to 35% by 2020, 50% by 2030, 65% by 2040, and 80% by 2050, providing policy for continuous improvement over 38 years.

Conclusion

Achieving an electricity system with high shares of variable renewable energy will be economically feasible only if complementary policies evolve with renewable energy standards. In particular, to create a more flexible electricity system that supports much more wind and solar, regulators will need to make deliberate choices about how utilities make money, how wholesale markets operate, and how we can transition away from existing fossil fuel generation.

Without these tools, the cost of the renewable energy transition may be higher than it needs to be, creating roadblocks to economic growth, shutting out energy-poor communities, and reducing the competitiveness of energy-intensive industries.