Electric Vehicle Policies

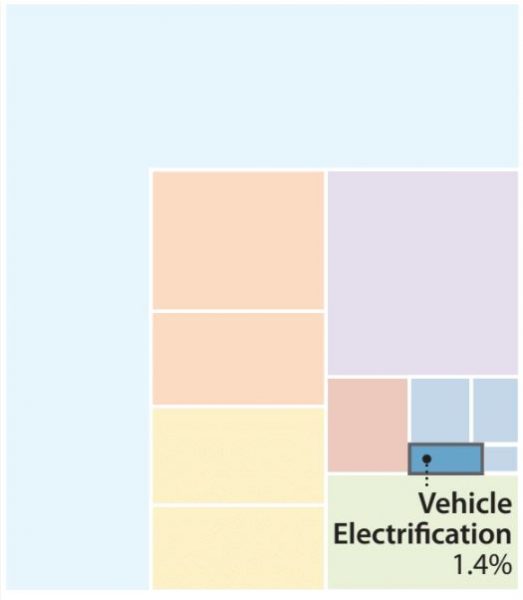

Potential emissions reductions from vehicle electrification.

The majority of people and goods are transported primarily by burning gasoline, diesel, and other petroleum-based fuels. Deploying technologies that reduce transportation sector emissions is key to decarbonization, and electric vehicles (EVs) are the most promising technology to achieve this goal. Properly deployed, EVs can contribute at least 1% of the cumulative global emission reductions needed to meet the two-degree Celsius target.

Effective EV policies include rebates and subsidies, charging infrastructure development, and consumer education. Policy effectiveness varies by location, and the right combination depends on if a country is developed or developing. Countries with a sophisticated transportation sector should adapt policies to increase private ownership of EVs like expanding access to charging stations, subsidizing EV purchases, expanding access to high-occupancy travel lanes on highways, and establishing EV sales mandates for vehicle manufacturers.

In developing countries, governments may be the most efficient procurer of EVs considering overall vehicle cost may exceed the financial reach their citizens. Government EV purchases may also facilitate deployment into particularly well-suited areas or ideal functionality. Subsidies in developing countries could also be targeted toward corporations with large vehicle fleets, intra-city delivery trucks, or trucks used in port operations. Deploying EVs in this manner helps incorporate lifetime total cost of ownership into purchasing decisions, optimizes infrastructure through central charging stations, maximizes fuel savings from regenerative braking through a stop-and-go duty cycle, and give utilities time to prepare grid infrastructure.

Decarbonizing the transportation sector requires large-scale deployment of EVs and government support to accelerate adoption in the near- and medium-term horizons. These policies should be designed with a long time horizon, and subsidy rates should track technological progress but phase out gradually according to a schedule or formula set years in advance.

Policy Description and Goal

Electrification of on-road vehicles is an important part of decarbonizing the transportation sector. A number of policies can be used to encourage suppliers and accelerate consumer adoption, including rebates and subsidies, development of charging infrastructure, electric vehicle (EV) sales mandates, and consumer education. It is crucial that these policies be designed with a long time horizon, that subsidy rates keep up with technological progress, and that they be phased out gradually according to a schedule or formula set in advance.

Programs in the U.S. state of Georgia and in China show the potential for policy to achieve success, as well as specific pitfalls to avoid. Good policy can hasten the day when EVs satisfy most on-road passenger transportation needs in cities around the world.

EVs offer two key benefits that help reduce emissions:

- EVs are three times as efficient as gasoline vehicles: 59%–62% of the electrical energy is converted into power to turn the wheels, whereas a gasoline vehicle converts only 17%–21% of the chemical energy in the fuel into useful work

- It is possible for electricity to be generated using zero-emission technologies, such as solar panels, wind turbines, hydro dams, or nuclear power plants, meaning the operation of an EV can have close to zero emissions

EVs also offer economic benefits to their owners. Their efficiency means that they cost little to operate: A typical electric passenger car can travel 43 miles for $1 worth of electricity. This is about one-fourth of the fuel cost of a typical 2016 gasoline-powered passenger car. Additionally, EVs have far fewer moving parts than vehicles with internal combustion engines (they typically need no radiator or transmission), so they are more reliable and need less maintenance.

If EVs have so many benefits, why do we need policy to help promote their commercialization and deployment? There are two major barriers slowing EV deployment. First, although their costs are falling rapidly, EVs still cost more than similar gasoline or diesel vehicles. Second, EVs need sufficient access to charging infrastructure. Most EV owners do most of their charging at home, but this may be a challenge for households that lack access to electricity in a garage or off-street parking space. Workplace charging and public chargers can fill gaps where at-home charging is unavailable or insufficient for the length of a given trip.

Policies to promote EVs typically aim at helping to overcome one or both of these barriers, or they provide other benefits (such as access to parking or expedited travel lanes) that increase the convenience of owning an EV.

Electrifying Buses and Trucks

Both light-duty vehicles, such as cars and SUVs, and heavy-duty vehicles, such as buses or trucks, can be electrified. However, because of different market characteristics, vehicle performance requirements, and level of technological maturity, policy considerations are different for electrification of buses and trucks than for passenger cars and SUVs.

Although the technology exists to electrify intracity buses, these buses are purchased primarily by government transit agencies, which are not responsive to the same pressures and incentives as consumers. Electric buses that draw current from guidewires were in use as early as the 1910s, but they need overhead infrastructure. Battery electric buses are a more recent invention, but they have a growing market share, with more than 200,000 electric buses sold in China alone in 2015 and 2016. In Shenzhen, the government recently completed a full transition of its bus fleet, all 16,359 of them, to electric buses.

Battery electric bus in service in Adelaide, Australia. Source: Wikimedia Commons.

The driving cycle of intracity buses has two key characteristics that make them highly compatible with battery electric drive trains: the prevalence of stop-and-go driving, which maximizes the value of regenerative braking, and regularly scheduled idle periods at specified locations, which offer an opportunity for high-voltage rapid recharging.

U.S. electric bus maker Proterra estimates that half of new bus sales to transit agencies may be electric by 2025, and all may be electric by 2030. The development of this market can be facilitated by deployment-driven cost declines and by government procurement policies, which can take into account the air quality and climate change benefits of electric buses when making new bus purchases.

Electric trucks have been in use through the 2010s and have been focused on intracity uses, such as delivery vehicles that make many stops, as well as trucks used for port and airport operations. The driving cycles of these trucks share many of the characteristics of the driving cycles of intracity buses, making them good fits for electrification.

Long-haul electric semi-trucks are still in their infancy and may someday achieve long ranges through systems involving leased batteries that are exchanged at battery swapping stations at truck stops along major routes. Increasing the penetration of electric trucks may depend heavily on policies that support research and development efforts that will deliver cost declines more rapidly.

Electrifying Motorbikes

In some countries, huge numbers of people ride motorbikes. Although motorbikes tend to be fuel efficient because of their light weight, they also tend to be heavily polluting because of their reliance on simple but dirty two-stroke engines and lack of emission control equipment, such as particulate filters. Governments may focus on promoting electric bikes as a substitute for traditional motorbikes, using the same policies discussed in this chapter in regard to passenger cars and SUVs.

The remainder of this chapter concerns primarily the electrification of passenger cars and SUVs.

Electrifying Passenger Cars and SUVs

Subsidies and Rebates

One of the most effective policies a government can use to encourage EV adoption is to directly subsidize the purchase of new EVs by businesses and consumers. For example, in the U.S., the federal government offers a tax credit of up to $7,500 per electric or plug-in hybrid vehicle, and some states and utilities offer their own rebates on top of this amount. For example, Colorado offers the highest state tax credit, of $5,160 per EV.

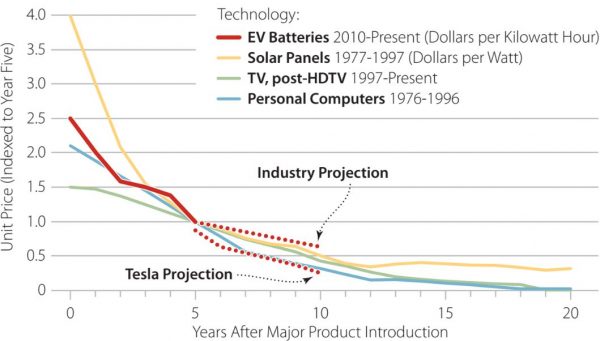

Subsidies are most effective when reflected in the sticker price seen by purchasers, so that they take the subsidy into account when making purchase decisions. Subsidies are generally intended as a temporary measure, to help make the upfront purchase price of EVs more comparable to that of gasoline vehicles. Subsidies may be phased out as research on battery technology brings down the cost of batteries and increased EV production lowers per-unit manufacturing costs through economics of scale. EV batteries have followed a price reduction pathway similar to that followed by other technologies, and battery costs are projected to decline by almost half over the next five years. EV battery costs have dropped more quickly than most industry experts and modelers projected over the past ten years.

EV batteries are expected to continue falling as with other comparative technologies after product introduction. Source: Citizens Utility Board.

Cost declines do not happen automatically with time. They depend on the increasing deployment of technology delivering economies of scale and also learning by doing: producers gaining experience making EVs and finding opportunities where small changes to processes can reliably reduce inputs, increase outputs, improve quality, and so on. Subsidies help promote deployment in the early years, thus making possible the very cost declines that allow removal of subsidies later. Although subsidies may appear to be an expensive policy in the short term, they may save money for society in the long run by bringing down costs and helping EVs to more rapidly achieve cost parity with or become cheaper than gasoline vehicles.

In addition to subsidies for the purchase of EVs, government may offer subsidies in the form of reduced bridge or roadway tolls, or they may provide free electricity for charging vehicles at public charging stations. For example, the San Francisco–Oakland Bay Bridge toll is $6 during commute hours for most passenger cars, but EVs (along with carpools) are charged a reduced rate of $2.50. This saves roughly $900 per year for a Monday–Friday, non-carpool driver.

Expanding Charging Station Access

EV owners need access to charging stations: connections to the electric grid that deliver electricity to vehicles. There are three types of charging stations.

- Level 1 chargers supply U.S.-standard 120-volt alternating current (AC) and can provide a typical EV less than 10 miles of range per hour of charge

- Level 2 chargers supply 240-volt AC and can transfer 10–30 miles’ worth of charge per hour, depending on the type of charger (there are several varieties)

- Level 3 or “quick” chargers can currently give a 240-mile-range EV 80% of its capacity in about half an hour

Most U.S. buildings have 120- and 240-volt connections to the grid, but Level 3 charging typically requires installation of special equipment. All EVs are able to use Level 1 and Level 2 chargers, but only select vehicles are equipped to use quick chargers.

EV buyers who own their own homes and have a dedicated garage or off-street parking space may choose to have a level 1 or 2 charger installed. However, this option is not typically available to renters (comprising 43.3% of U.S. households, for example), who often do not have the ability to make upgrades to their building, or those who do not have a reserved or consistently available parking spot at which to install the charger.

Similarly, owners of office buildings, shopping malls, and other commercial real estate may be reluctant to install charging equipment if they do not expect a financial return from doing so (e.g., by being able to charge higher rents to commercial tenants).

An EV charging while plugged into power supply. Source: Shutterstock.

Government can make the process easier by offering rebates or tax incentives to individuals, multi-unit residential buildings, and businesses that install chargers in parking areas. Subsidies may be made contingent on conditions such as public access to the chargers or participation in utility efficiency or smart charging programs.

Local governments may change building codes to require that new or significantly renovated buildings above a certain size include a certain number or share of chargers in garages or parking lots.

Government may also work with companies to deploy chargers in public areas, such as city-owned parking lots or alongside streets. There are several ways to pay for these stations. For example, the government may solicit bids from private companies and directly fund the charging stations.

Public utility commissions, which regulate electric utilities, can also permit utilities to recover the costs of building a specific number of charging stations in the rates they charge to customers. Utilities can expect to recoup their investment in charging infrastructure through sales of electricity to vehicles and by using vehicle charging as responsive demand, to accommodate instances of short-term oversupply of power to the grid.

Three utilities in California—San Diego Gas & Electric, Southern California Edison, and PG&E—received approval from the California Public Utilities Commission to deploy thousands of charging stations (including some in multi-unit dwellings and at businesses). Utility regulators and stakeholders are beginning to recognize that transportation electrification can benefit all utility customers because the additional utility company revenue from EV charging can support operation and maintenance of the existing distribution infrastructure, helping reduce the need for future electricity rate increases.

Either the direct incentive or utility EV program approach allows government to impose conditions on the program, such as a requirement to deploy a certain share of chargers in disadvantaged communities or a requirement to bill electricity for charging at special rates, which are often important considerations.

Roadway and Parking Privileges

Another way government may increase the attractiveness of EVs is to provide non-monetary benefits to EV owners, such as access to special travel lanes on highways during peak commuting hours. Similarly, the government may make special parking spaces available only to EVs—often the ones with charging infrastructure. These policies increase the convenience of driving and parking an EV.

The benefits of access to special travel lanes and parking spaces derive from the limited number of vehicles that may use these services. As EVs achieve higher market share, it may be necessary to withdraw roadway and parking privileges.

Consumer Education

Government or utilities may provide consumers with information about EVs, such as projected savings on fuel and maintenance, charging options, public databases of charging station locations, reduced air pollution, and available incentives. There is a need for high-quality, objective information about EVs.

Dealers often steer buyers away from electric cars because they need almost no maintenance, and dealers make three times more profit from servicing vehicles than from new car sales. Some dealers have refused to allow prospective buyers to test-drive EVs, and others have played up perceived drawbacks such as range limitations and withheld information on the benefits of EVs. Government may provide information through partnerships with community and environmental organizations, awards for top electric vehicle sellers, print or online media, partnerships with utilities, and so on.

Zero-Emissions Vehicle Mandates

A government may mandate that automakers sell at least a certain percentage of zero-emission vehicles or EVs. This is a technology-pushing policy, helping to ensure automakers are investing in zero-emission vehicle technologies and making the resulting products available to consumers.

Automakers may comply with a mandate by making larger numbers of EVs and more models available for sale, promoting EVs via marketing or consumer education, and reducing the price of EVs until consumer demand is sufficient to allow compliance with the mandate. A zero-emission vehicle mandate may be based on tradable credits, allowing manufacturers that are unable to generate sufficient credits from their own sales to buy credits from other manufacturers. Unlike a subsidy, a zero-emission vehicle mandate does not require government expenditures, although a stringent mandate will incur costs to automakers in the near term.

California and nine other U.S. states participate in a program that mandates EV sales. Each automaker is required to sell a sufficient number of EVs to meet its zero-emission vehicle credit obligations. This translates to sales of EVs rising from 2% of overall sales in 2018 to 8% by 2025. The actual number of electric cars sold may vary, though, because automakers generate fewer credits for selling a plug-in hybrid with a gasoline engine, a vehicle that only partially runs on electricity, and more credits for a battery-EV powered exclusively by electricity. (Unfortunately, partial credits were cheap and easy to attain, leading to an oversupply of credits and reducing pressure on manufacturers to deploy zero-emission vehicles. The problems with oversupply illustrate the importance of careful policy design to ensure policy effectiveness.)

Zero-emission vehicle mandates are spreading worldwide. China, the world’s largest auto market, has announced its own zero-emission vehicle mandate, which will require 8% of automakers’ sales to consist of zero-emission vehicles by 2019. The European Commission is considering a similar mandate program for Europe.

When to Apply These Policies

Although EVs are a new technology, they hold promise for both developed and developing countries, so all countries should be using policy to prepare for and facilitate a transition to EVs.

That EVs fit well in developed countries may be unsurprising: Developed countries have the money to afford new technology, and EVs will be a crucial component of efforts to decarbonize the transportation sector and achieve aggressive greenhouse gas emission reduction targets. But EVs are a surprisingly good fit for developing countries as well:

- Most developing countries do not produce large quantities of oil or petroleum fuels domestically, so they must import the fuel for gasoline- and diesel-powered vehicles, sending precious cash abroad. EVs run on electricity, most of which is produced domestically, and they go much farther per dollar spent on fuel. This provides mobility services more cheaply, and more of the money spent on energy remains in-country.

- As they industrialize, many developing countries are suffering from terrible air quality. For example, air pollution in China and India kills millions of people per year. On top of the direct humanitarian and economic costs, air pollution makes cities undesirable places to live and work. This can be a drag on the development process. EVs reduce harmful air pollution in cities. Ideally, electricity will be supplied by zero-emission technologies such as solar, wind, hydro, and nuclear, but even natural gas emits very few particulates (the most damaging type of air pollution to human health). Even if the electricity for EVs is supplied by coal, the coal plants can be located far from population centers, whereas gasoline and diesel vehicles emit pollution in the hearts of dense cities, where more people are exposed to the pollution.

- Whether or not EVs are deployed, developing countries commonly seek to build out a robust electric grid, to supply their citizens with power. EVs can use much of the same grid infrastructure and can even help contribute to grid stability; For example, by varying their charging rates based on the needs of the grids during different parts of the day, EVs can provide a valuable grid service. A developing country whose population still largely lacks access to private vehicles may be able to leapfrog internal combustion engine vehicles in favor of EVs. This might allow countries to avoid investing in costly infrastructure for gasoline vehicles, such as pipelines, refineries, tanker trucks, and fueling stations.

- EVs are more reliable and have fewer moving parts than internal combustion engine vehicles, so they may need fewer repairs over their lifetime, lowering the total cost of ownership.

The biggest concern about EVs in developing countries is cost. Although EV prices are dropping rapidly, they remain more expensive to purchase than similar petroleum vehicles. The price gap is shrinking, however, and developing countries should plan their infrastructure and their policy for the long term, when EVs will be cheaper than internal combustion engine vehicles. Nonetheless, because of differences in grid readiness and in citizen and government resources, different policies are best suited to facilitate EV deployment in developed and in developing countries.

In developed countries, policy should focus on starting broad displacement of privately owned internal combustion engine vehicles by EVs. Expanding access to charging stations and facilitating deployment of at-home chargers (e.g., by ensuring a fast, efficient, and inexpensive permitting process for home installation) is a priority. Developed countries can afford to subsidize EVs, and EV subsidies have been used in many European countries, the U.S., Canada, and elsewhere. Access to high-occupancy travel lanes on highways has proven to be a major factor in consumers’ purchase decisions, and EV sales mandates may be achievable by vehicle manufacturers.

In developing countries, it may be advantageous to begin by facilitating deployment of EVs in ecosystems and roles for which they are particularly well suited. For example, a government can choose to procure EVs for its vehicle fleets, and it may make subsidies or other incentives available for the electrification of corporate vehicle fleets, intracity delivery trucks, and trucks used in port operations. These are environments where purchase decisions are made by professionals who can take account of lifetime total cost of ownership of the vehicle, where the vehicles often return to a central location where they can be charged, and where vehicles have a stop-and-go duty cycle that maximizes the fuel savings from regenerative braking. Starting with EV deployment in specific ecosystems or roles also gives utilities time to prepare grid infrastructure for more widespread EV deployment.

When a developing country is ready to begin rolling out EVs to private citizens on a widespread basis, a feebate is one of the first policies to consider. A feebate can have a powerful effect on consumer choices, because it combines the effects of a tax and a subsidy, and it modifies the upfront purchase price, the most salient factor to most consumers (as opposed to the lifetime cost of ownership, because most consumers heavily discount or disregard future fuel savings). A feebate also is affordable for a low-resource government, because the feebate can be revenue neutral, unlike a pure subsidy.

Detailed Policy Recommendations

Create a Long-Term Goal and Provide Business Certainty

When using subsidies to promote EV adoption, the subsidy rates and eligibility of different vehicles should be established and publicly announced at least several years in advance. When subsidies phase out, they should do so according to a schedule, also known years in advance. These steps prevent abrupt or unexpected changes in subsidy rates that can lead to sudden crashes in sales and harmful disruption to the automobile manufacturing industry.

For example, when the U.S. state of Georgia abruptly repealed its $5,000 EV tax credit and replaced it with an annual $200 fee on EVs, registrations of new EVs plunged by 90%. Georgia’s tax credit is discussed in greater detail as the first case study in the next section.

If flexibility is necessary because of uncertainty in the rate of future technological advancement, the subsidy phase-out may be based on the cost differential between internal combustion engine vehicles and EVs of the same type (e.g., midsize cars, SUVs). In this case, the formula to be used to calculate the subsidy, rather than the ultimate subsidy value, would be publicized in advance.

Use a Price-Finding Mechanism

If a policymaker’s goal is to achieve a particular level of EV sales, it may be prudent to use a price-finding mechanism to determine the lowest subsidy rate that would achieve the desired sales level. This is not how EV subsidies are usually structured today, either because policymakers do not have a specific EV deployment target or because they have a particular quantity of funding that they are willing to spend on the subsidy program, which they are not willing to exceed, even if this will cause the target to be missed.

To make the funding for a subsidy program go as far as possible, the subsidy may be targeted at buyers who wouldn’t have purchased the vehicle otherwise. One approach is to target middle-income consumers rather than upper- income consumers or to limit incentives to lower-priced electric vehicles.

A price-finding mechanism may be applied to the deployment of EV charging infrastructure by soliciting bids from various providers. The company that presents the lowest-cost bid that provides the most chargers in the most useful locations may get the contract.

Eliminate Unnecessary “Soft Costs”

Policymakers should streamline the process of registering EVs and obtaining permits to install charging infrastructure in homes and businesses. To install a car charger, some cities require a new owner to submit a building permit, floor plans, electrical service load calculations, and other documentation, along with associated application fees.

Utilities should ensure the electric grid is able to handle the load from EVs and pre-certify neighborhoods or other large areas, reducing or eliminating the need to perform load calculations on a case-by-case basis.

Government may provide basic templates explaining key choices, such as where to locate a charger relative to the parked vehicle and whether to install a second electric meter (in places where a special, lower electricity rate is charged for electricity used to charge EVs).

Apply the Policy to the Smallest Set of Actors that Achieves 100% Coverage of the Market

If subsidies are used, they should be available to all EVs that meet certain performance requirements (such as a minimum battery size). In the U.S., the federal EV tax credit phases out on a per-manufacturer basis once a manufacturer has sold 200,000 qualifying vehicles. Although no manufacturer has reached this limit yet, several manufacturers will soon, but the tax credit will remain available to other manufacturers for many years.

This policy design may encourage each automaker to consider entering the EV market. However, it will lead to fewer subsidies going to manufacturers who are leading the market, which are generally the early movers that offer the least expensive or best-quality products. It is better for the market and for emission reduction if policies are manufacturer neutral and reward the best technology.

If 100% of the market cannot be targeted (perhaps because a country is in too early a stage of development), then high-impact use cases should be targeted first, such as short-haul commercial trucking, corporate or government vehicle fleets, taxis, or private vehicles in the most developed urban areas with better grid infrastructure support. This will help to lay a foundation to facilitate increasing penetration of EVs over time.

Other Design Considerations

Policies designed to maximize the adoption of EVs may have unintended side effects, such as exacerbating income inequality or favoring urban over rural residents. In California, households in the top income quintile received 90% of all EV tax credits, a transfer of general tax revenues to the highest earners. Policies that promote EVs also tend to have less impact on rural areas, where travel distances are longer and charging infrastructure is scarcer.

One way to limit the impact of EV promotion policies on inequality is to allow subsidies only for buyers (or lessees) with income below a certain cap or to limit subsidies to vehicles priced cheaply enough that they are available to the majority of citizens. Although EVs may be unlikely to become popular in rural areas in the near term (because of range and cost concerns), governments can prepare for eventual rural EV adoption by extending charging networks into rural areas. The best spots may be along major travel corridors such as highways, so that the chargers can be used by either local residents or passing motorists, improving their economics.

Additionally, it is worth noting that in some cases, policies that benefit primarily higher-income earners in the short term can benefit all consumers in the longer term. Early adopters, such as the first EV drivers in California, assumed the risk of buying an untested technology for which the supporting technological infrastructure—such as chargers—had not been widely deployed. This provided a market for EVs, helping manufacturers innovate and pushing EV prices down their learning curves, yielding cheaper products for the broader market in the future. Early adopters also contribute to social acceptance of EVs as capable and reliable vehicles, laying the groundwork for EV market development.

Case Studies

Georgia EV Tax Credit

In the 1990s, Atlanta was out of compliance with federal air quality standards for ozone, and vehicle emissions were primarily responsible. In 1998, the legislature passed a $1,500 tax credit for alternate fuel vehicles, which was increased to $2,500 for all low-emission vehicles and $5,000 for zero-emission vehicles over the next three years. The tax credit applied to buyers and first lessees of EVs. At the time, the bills were uncontroversial.

As years passed, EVs became more widely available and declined in cost. The tax credit was successful at helping EVs gain a foothold in Georgia, particularly in Atlanta, where the range limitations of early EVs were less problematic than in rural areas. By mid-2015, Georgia had more EVs in service than any other U.S. state except California.

EV costs declined and availability increased during this period. In 2015, one of the least expensive EVs, the Nissan Leaf, had a sales price of $30,000, or $22,500 after the $7,500 federal tax credit. Dealers began offering 2-year leases for as little as $199 per month. Georgia’s $5,000 tax credit, spread over 24 months, could cover the entire cost of the lease.

The ability to essentially own an EV for free drew the ire of legislators representing rural portions of the state, who portrayed the policy as “giving free cars to Atlanta yuppies.” EV advocates recommended cutting the tax credit in half, then phasing the remaining half out over three years. Going even further, the state passed a bill that terminated the tax credit abruptly and also imposed an annual $200 fee on EVs, the steepest such fee in the country. As a result, the market crashed, with registrations declining by 90%.

This was a desired outcome for Rep. Chuck Martin, the legislator who sponsored the bill to repeal the tax credit, who stated that the drop-off in sales “vindicates that the credit needed to be removed.” However, it is not a good result for the future of EVs in Georgia, nor for mitigating climate change.

Several lessons can be drawn from Georgia’s experience:

- Subsidies must be revisited at known intervals to keep up with technological change. Georgia’s subsidy rate, set to $5,000 in 2001, became overly generous more than a decade after it was enacted.

- The policy failed to account for distributional effects (described earlier). For example, if some of the benefits had accrued to rural areas, it might not have garnered so much opposition.

- Abruptly ending a subsidy policy can cause a dramatic shock to the EV industry. Financial incentives should be phased out according to a multiyear schedule (potentially linked to the cost differential between gasoline vehicles and EVs, as noted earlier).

- When a subsidy is offered to a lessee rather than a buyer, it may be prudent to spread out the value of the subsidy over time. When the entire subsidy is provided to the first lessee, this makes the car cheap to lease for the first lease term, but the lessor may have difficulty leasing or selling the vehicle when that term expires because the subsequent lessee or buyer will not get any tax credit. A policy that (for example) awards only 20% of the tax credit to a lessee per year would ensure that the benefits are spread out among the first five years’ worth of lessees (or buyers, if the car were sold within the first five years).

China’s EV Subsidies

In 2009, China adopted an ambitious plan to become the world leader in EV technology and manufacturing. The plan included large subsidies for EVs sold in the domestic market, and the central government ordered State Grid, the Chinese electricity system operator, to install charging stations in major cities.

Chinese manufacturers began producing EVs in large numbers. To keep EV prices as low as possible, an important goal in the price-sensitive Chinese market, companies designed EVs with poorer performance characteristics than those sold in many other countries. A typical Chinese EV may have a range of 120 miles and a top speed of 60 miles per hour. However, these limitations have been acceptable to Chinese consumers, who drive primarily short distances in cities, where top speeds are limited by traffic.

A top selling model in China in 2017, the Chery eQ, costs 60,000 yuan ($8,655) after subsidies. Without subsidies, the price would be 160,000 yuan ($23,080). The Chinese government also exempts EV owners from vehicle ownership taxes, which can be very expensive, sometimes costing more than the vehicle itself.

Because of the availability of these extremely cheap EVs, the market boomed. Today, China possesses 38% of the world’s EVs, more than three times as many as the U.S. 2016 sales were 507,000 units, more than twice the sales in Europe and more than four times the sales in the U.S.

The subsidies have “helped cultivate a gold-rush mentality,” with more than 200 manufacturers, some of whom have little expertise in building high- quality vehicles, hurrying to sell hastily constructed EVs in order to pocket the subsidies. The value of the subsidies also enticed some manufacturers to commit fraud by illegally registering vehicles, using smaller batteries in production than in testing, and falsifying sales figures.

To remedy these problems and force manufacturers to improve the quality of the vehicles they sell, the Chinese government has begun improving enforcement, mandating better energy consumption and driving distance in order for vehicles to qualify for subsidies, and will phase out its EV subsidies by 2020. The central government has also capped the level of subsidy that provincial governments may offer for EVs. Going forward, China is considering instead using a zero-emission vehicle mandate modeled on the California mandate discussed earlier, which will obligate vehicle makers to continue the transition to EVs without providing financial reward to firms making low-quality products.

The Roewe E50 is an electric vehicle released by Chinese manufacturer SAIC Motor in 2013. Source: Wikimedia Commons.

Improving EV quality will be crucial for Chinese manufacturers to expand their sales into foreign markets, a goal of GAC Motor and BYD, two of China’s biggest EV manufacturers.

Using a combination of generous subsidies and government-mandated charging infrastructure buildout, China was able to become the world leader in EV deployment in half a decade. By taking steps to improve vehicle quality and withdraw subsidies gradually, according to a schedule announced years in advance, China is well set to avoid a dramatic crash in EV sales, such as that experienced after the sudden withdrawal of subsidies in Georgia.

If the Chinese policies had required better performance in order to qualify for subsidies earlier in the lifetime of the subsidy program, they might have avoided the proliferation of companies making low-quality EVs, saved government money, and prepared Chinese EVs for export to developed markets more quickly. Despite this flaw, the Chinese program has been successful at achieving its goal of making China a world leader in EV manufacturing.

Conclusion

Electrification of on-road vehicles will be an important part of decarbonizing the transportation sector. Although EV technology has come a long way, it still needs government policies to accelerate adoption, at least in the near and medium term. Key techniques for policymakers include rebates and subsidies, development of charging infrastructure, and consumer education.

It is crucial that these policies be designed with a long time horizon, that subsidy rates keep up with technological progress, and that they be phased out gradually according to a schedule or formula set years in advance. Programs in Georgia and China show the potential for policy to achieve success and specific pitfalls to avoid. With well-designed regulatory incentives and cost declines from advancing technology, quiet, zero-emission EVs can quickly become a common sight in cities worldwide.