Vehicle And Fuel Fees And Feebates

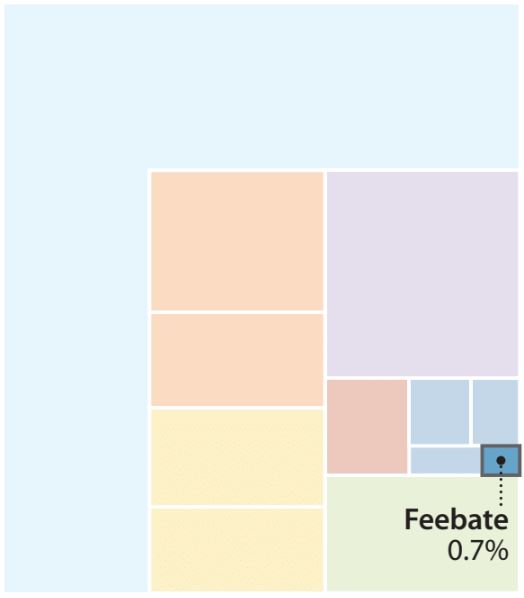

Potential emissions reductions from feebates.

Many countries have instituted fuel and vehicle fees to decarbonize the transportation sector and direct revenue for related projects like road construction and public transit. If invested properly—targeting improvements such as urban mobility measures, efficiency, and research and development (R&D) for new clean transportation technologies—these fees can contribute around 1% of the cumulative global emissions reductions necessary to reach the two-degree Celsius target.

Fuel fees account for social costs of fossil fuel consumption like climate change or health effects through slightly higher prices for fuel reinvesting revenue generated by the fees into projects that decarbonize other segments of the economy. Vehicle fees are designed to reduce the number of people who choose to travel by car, and if the fees are tied to fuel efficiency, they can push consumers toward purchasing more efficient vehicles while encouraging manufacturers to produce more fuel efficient models.

Feebates incentivize development and deployment of more efficient vehicles by offering a payout to reward buying the most efficient vehicles. Manufacturers are incentivized to conduct R&D and manufacture more efficient models in order to take advantage of this rebate and sell more cars. Feebates are a particularly good complement to vehicle performance standards, which are especially effective at improving the worst- or lowest-performing vehicles.

Fees are powerful decarbonization policies that reduce driving, encourage more efficient vehicles, reflect the social cost of burning fuel, reduce fuel use, and provide revenue to fund urban mobility projects. Feebates are a powerful incentive to buyers and vehicle manufacturers to opt for more efficient vehicles, and the pivot point can be adjusted to achieve the government’s revenue goals. Together, fuel fees and vehicle feebates can drive transportation sector decarbonization.

Policy Description And Goal

Fuel fees are taxes levied on vehicle fuels. They should reflect all negative externalities caused by fuels and should be implemented upstream in the supply chain. Revenues from fuel fees can be used to mitigate regressive impacts or to accelerate air pollution or greenhouse gas reduction programs.

Vehicle feebates provide a rebate to purchasers of efficient vehicles, funded by fees levied on purchasers of inefficient vehicles. For feebates to be effective, governments can reduce regulatory hurdles and minimize the effort involved in obtaining a rebate. Feebates should apply to all vehicles in the same class (e.g., all passenger light-duty vehicles).

Fuel fees and vehicle feebates can encourage increased new vehicle fuel economy while reducing vehicle distance traveled. Fees and feebates should be long-term policies with a clear implementation schedule. Their stringency (set points and strength) can be adjusted over time as technology improves. They can contribute at least 1% of cumulative emissions reduction to meet a two-degree target through 2050 through three related types of policy:

- Fees charged on carbon-based fuels

- Fees charged on newly sold on-road vehicles, primarily passenger cars, SUVs, and freight trucks

- A feebate, a fee or a rebate for newly sold vehicles varying based on their efficiencies

Vehicle fees and feebates are most effective in helping reduce fuel consumption of on-road vehicles. Commercial airliners, large cargo ships, and trains have decades-long lifetimes and high manufacturing costs, and therefore a fee or feebate of sufficient magnitude to substantially affect the economics of buying and operating one of these non-road vehicles over its lifetime may be politically difficult.

Fuel fees, on the other hand, have an ongoing effect on the economics of aircraft, rail, and ships over these vehicles’ lifetimes and may be more effective at influencing manufacturers to improve non-road vehicle efficiency. Significant improvements are possible; for instance, new aircraft designs could cut fuel consumption by up to 40%. However, because fuel and vehicle fees and feebates apply mostly to on-road vehicles today, the remainder of this chapter will consider only on-road transportation modes.

Fees on Carbon-Based Fuels

In some countries, fuel taxes are implemented at multiple levels: The national government, states or provinces, and localities can all charge taxes on fuels. In most cases, the fee is implemented as an excise tax, or a tax on a particular volume of fuel sold. (In contrast, a sales tax is based on the purchase price.) Some U.S. states have taxes that vary with the underlying price of fuel or other factors.

Fuel taxes are levied on the seller, who often passes some or all of the cost increase on to consumers. Fuel taxes influence drivers via two different mechanisms: how much to drive existing vehicles and which new vehicles to purchase. Fuel taxes increase travel costs, which will cause some people or businesses to reduce travel demands or shift trips to a different form of transportation (such as biking, walking, or public transit for people; or for freight, a more efficient mode per ton of goods transported, such as rail). This effect can happen quickly, because it does not require vehicle fleet turnover.

When a consumer or business is ready to buy a new vehicle, they may consider the cost of fuel when deciding which model to purchase. More fuel-efficient models will be more attractive if fuel prices are higher. Because this effect depends on the vehicle fleet turnover rate, fuel prices must be sustained at a higher level for an extended period (if not permanently) for this effect to significantly improve fleet-wide fuel economy.

Fees on carbon-based fuels are particularly useful to counteract the rebound effect of improved vehicle efficiency. If vehicles become more efficient (perhaps because of vehicle performance standards or market demand for more efficient technologies), the cost of driving goes down. This induces people to drive more, which offsets some emission benefits of vehicle efficiency (about 10% for passenger vehicles and 15% for trucks in the U.S.). Fuel taxes can offset this rebound effect.

It is important to note that fuel fees are not likely to result in significant behavioral changes, at least at politically feasible levels. Therefore, fuel fees are particularly valuable as a revenue raising mechanism. Revenue from fuel fees can be used for other policies or programs, such as clean vehicle rebates or public transit infrastructure, which can further reduce emissions and provide the public with transportation alternatives.

Fees on Newly Sold Vehicles

In addition to applying fees to transportation fuels, some regions also charge a fee when new vehicles are purchased. This may come in the form of an excise tax or a permit to own and operate the vehicle in a given area. For example, the Shanghai region auctions permits for new vehicles, and permit prices can be considerably more expensive than the vehicle purchase price itself.

Although a flat fee per vehicle can help encourage shifting to other transportation modes, it does not encourage purchasing more efficient cars over less efficient ones. However, a fee can vary based on car efficiency or fuel type to achieve this goal.

For example, in Norway, high auto taxes are waived for battery electric vehicles, although these incentives have started to be phased out. Similarly, Denmark formerly waived its high taxes on new vehicle sales on electric cars, although a new, center-right government began phasing out this exemption, causing electric vehicle sales to drop 60% in one year. This illustrates the importance and effectiveness of these policies in affecting consumer buying decisions.

Feebates

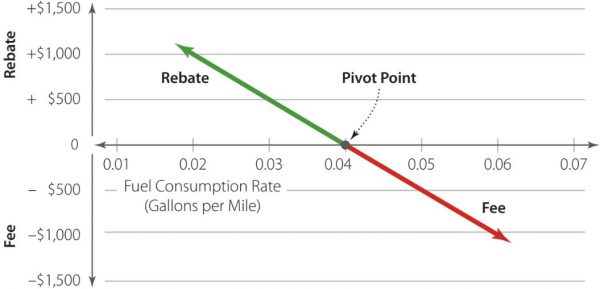

A feebate is a fee combined with a rebate under one policy. Buyers of inefficient cars are charged a fee at the time of sale, and buyers of efficient cars receive a rebate. Regulators determine a policy target, referred to as a pivot point, as the efficiency level at which a car neither incurs a fee nor receives a rebate. The feebate rate (how quickly the fee and the rebate escalate as one moves away from the pivot point) and whether it is levied as a tax or rebate is then determined based on how much a new vehicle’s fuel efficiency is better or worse than the target.

Illustrative design of a feebate. Source: Kiplinger.

The government may design the feebate with its revenue goals in mind. For instance, setting a higher efficiency target can make more vehicles pay the fee than will receive rebates, resulting in a revenue stream to fund public transportation or other government projects.

Conversely, setting the target at a level where the sum total of all fees in a year equals the sum total of all rebates paid can make the feebate revenue neutral. In order to maintain revenue neutrality, the target must be adjusted frequently to keep up with changes in the efficiencies of cars offered by manufacturers and the buying preferences of the public.

It is also possible to reward extremely efficient cars (those with fuel efficiency far better than cars at the target) by establishing an efficiency level beyond which the feebate offers an increased subsidy rate. Offering a higher subsidy rate for extremely efficient vehicles can help promote the development of more advanced efficiency technology.

When To Apply This Policy

Fees on Carbon-Based Fuels

Fees on carbon-based fuels can achieve three central goals of transportation vehicle policy:

- Discourage driving by making fuel more costly

- Encourage the purchase of new vehicles because older, less efficient vehicles are more expensive to drive

- Encourage consumers to purchase more efficient vehicles (which also encourages manufacturers to produce more efficient vehicles) because they cost less to drive. Therefore, fees on carbon-based fuels are broadly applicable.

Fuel fees also help incorporate the social costs of fuel consumption, such as the contribution to climate change or health impacts, into the price paid by consumers. Additionally, revenues from fuel fees are likely to be substantial, and they can be reinvested in projects aimed at reducing the impacts of fuel burning (e.g., by decarbonizing the economy and providing medical services). For these reasons, fuel fees are an appropriate and effective policy.

Vehicle Fees and Feebates

Vehicle fees are useful to reduce demand for travel by car and, if the fees vary with fuel efficiency, help steer consumers toward purchasing more efficient vehicle models and manufacturers toward designing more efficient models.

Because consumers sometimes strongly discount fuel savings when deciding which car to buy, fees and feebates can improve the efficiency of newly purchased vehicles by moving some of the economic impact upfront, where it may be considered more thoroughly by vehicle purchasers. A small fee on conventional fuel vehicles could also be used to create a sustainable budget for subsidizing electric vehicles and other alternative fuel vehicles.

Feebates are useful for incentivizing the development and deployment of new, more efficient vehicle models. By offering a payout that scales with efficiency, feebates reward buying the most cutting-edge, efficient vehicles. Manufacturers are incentivized to conduct R&D and manufacture more efficient models in order to take advantage of this rebate and sell more cars. This means feebates are a particularly good complement to vehicle performance standards, which are especially effective at improving the worst- or lowest-performing vehicles.

A flat vehicle fee, such as an annual registration fee, can be helpful for congested cities, such as Shanghai, where it limits the number of cars on the roads and generates substantial revenue for improving the attractiveness and convenience of other transportation modes such as walking, biking, and public transit.

In contrast, a graduated fee or a feebate is best when the main goal is incentivizing the development and sale of more efficient vehicles, and it works better at a larger scale (such as national policy) than at the local or even the state level.

A feebate can lead to odd outcomes if it applies only to a specific region, because people who want to buy inefficient vehicles can purchase them from a neighboring region without a feebate. Meanwhile, people who want to buy efficient vehicles purchase them in the region where the feebate will benefit them.

This phenomenon has actually happened in Shanghai, where residents purchase cars in neighboring provinces to avoid Shanghai’s expensive license plate fee. As a result, the government pays for many rebates while taking in little money in fees, thus not achieving the policy outcome of increasing the share of efficient vehicle purchases. Charging a fee upon vehicle registration rather than at the point of sale could help mitigate this loophole and ensure the feebate is more accurately enforced.

Detailed Design Recommendations

Policy Design Principles

The following policy design principles apply to vehicle and fuel fees and feebates.

Create a Long-Term Goal and Provide Business and Consumer Certainty

Fuel taxes should be levied indefinitely, because fossil fuel externalities do not diminish with time. Long-term fuel tax certainty empowers manufacturers to invest in R&D projects improving fuel efficiency, knowing there will be a market for these vehicles years down the road when they are ready. It also gives consumers a stronger incentive to buy more efficient vehicles. Consumers uncertain whether a fuel tax will be maintained in the future might buy a less efficient car in hopes the tax will be reduced or suspended.

Taxes and fees should always be indexed to inflation so they remain consistent in real terms. The tax may need to increase if vehicles become more efficient, to prevent the incentive from being eroded and to prevent an increase in driving caused by the rebound effect (discussed earlier). One option is to build in an adjustment mechanism that indexes the tax to the average vehicle fleet efficiency.

Vehicle fees and feebates should similarly be publicly known many years in advance to maximize their incentive effect and ensure that consumers do not hold off on purchasing a new vehicle in hopes of getting one when the fee lapses. Vehicle fees and feebates may not be permanent—for example, if the transportation fleet transitions to clean energy and if congestion in urban areas is no longer a concern—but because these goals are many years away, vehicle fees and feebates are likely to remain valuable policy tools for the foreseeable future.

Price in the Full Value of all Negative Externalities for Each Technology or Use a Price-Finding Mechanism

Fuel taxes should price in the full value of all social harms. These include public health impacts due to local pollutant emissions, climate change impacts, congestion impacts, infrastructure impacts, and traffic accidents. Fuel taxes could also be applied on an energy-equivalent basis, rather than deriving the externality costs for each fuel, which could be difficult in some circumstances.

Some of these negative impacts, such as traffic accidents, apply to all vehicles regardless of what kind of fuel they use. In these cases, a separate fee could be levied on all vehicles to cover those impacts, in which case it need not also be factored into a fuel tax.

A price-finding mechanism is most appropriate for vehicle fees in crowded urban areas where the maximum number of cars is known. Auctioning permits is a straightforward way to accomplish this.

Adjustment of the feebate pivot point is also price finding, because the adjustment accomplishes a specific revenue-related goal (e.g., achieving revenue neutrality or obtaining a particular amount of net revenue for other projects). The correct pivot point price is revealed by buyers’ choices.

The rate of a feebate might also be designed to be price finding. The policymaker first needs to identify a desired performance outcome—in this case, a specific magnitude shift in the efficiency of the average car sold. Then, various feebate rates can be tested, either in the real world or through studies, to find the feebate rate that achieves the targeted efficiency increase.

In some instances, particularly for vehicle and fuel fees, the additional charge may not result in large behavioral changes that eliminate the externalities. Therefore, these policies are particularly helpful as a revenue mechanism to create funding for rebates and other programs to promote the adoption of more efficient, cleaner vehicles and to pay for alternatives to car travel, such as public transit.

Eliminate Unnecessary “Soft Costs”

If significant regulatory hurdles to the purchase or operation of a vehicle exist in a given region, those hurdles could be lowered for particularly efficient or zero-emission vehicles, making it faster and easier to obtain these models.

For example, electric vehicles could receive expedited permit processing or a minimum number of permits in regions that conduct auctions for vehicle permits.

If a rebate is offered on efficient or zero-emission vehicles, the rebate can be handled by the dealer (or the manufacturer, in the case of manufacturers who sell directly to the public). That way, the dealer or manufacturer is responsible for submitting relevant government paperwork and simply includes the rebate value in the car price seen by consumers. However, careful monitoring is needed to ensure manufacturers do not game the feebate system under this approach by applying for the rebates and retaining the subsidy.

Capture 100% of the Market and Go Upstream or to a Pinch Point When Possible

It should not be easy for manufacturers to substitute other types of fuel or vehicles that have similar negative externalities simply to evade fuel or vehicle fees.

If a fee is applied only to petroleum gasoline, and cars are capable of burning ethanol, this risks consumers switching to ethanol to avoid the fee. Therefore, fuel fees should be set on all carbon-based fuels, not solely on petroleum fuels or on gasoline. Fees should be based on pollution emission intensity (grams of each pollutant emitted per unit usable energy in each fuel) or carbon intensity of fuel so consumers are still encouraged to purchase the lowest carbon- emitting fuel type.

One of the main hazards to avoid is applying different fees, or a feebate with different pivot points, to vehicles distinguished by characteristics readily modified by manufacturers. For example, automakers started manufacturing and marketing SUVs to consumers partly because they were subject to weaker vehicle performance standards than were passenger cars. This led consumers to buy larger and less efficient SUVs, impairing the policy effect.

Ensure Economic Incentives are Liquid

Rebates associated with feebates should be provided as an immediate discount on the vehicle’s purchase price or a promptly delivered cash payment.

If the payment is issued as a tax credit, even a refundable tax credit, the psychological impact of the rebate on consumers is diluted by separating it in time from the vehicle purchase. It also increases hassle by requiring consumers to take extra steps (on their tax returns) to receive it.

Additional design considerations

If vehicle and fuel fees are designed according to the principles described earlier, only a few remaining points must be tackled.

Mitigate Regressive Impacts of Fees

Like sales taxes, fuel and vehicle fees tend to be regressive; they disproportionately affect people with lower income. People with lower incomes spend a higher percentage of their income on transportation, and thus a higher percentage of their income goes into these fees.

Additionally, lower-income groups may have older and less efficient vehicles, causing them to buy more fuel per mile traveled, increasing the amount of fuel-based fees they pay.

Regressive fees can be mitigated through socially aware use of the resulting revenues. Revenues funding better public transit, particularly urban bus and metro systems serving low-income neighborhoods, provide alternative means of mobility to low-income residents at affordable prices. Funds can also be directed to non-transportation programs benefiting low-income residents, such as improving the quality of schools in low-income areas.

Another option is to rebate the fees to society as a flat payment to each person (a “dividend”) or a graduated dividend with higher values going to lower-income people. (Dividend payments should not be based on fuel use or fees paid in order to avoid eroding the incentive created by the fees.) With smart use of funds, the benefits to low-income residents can significantly outweigh added costs from fuel and vehicle fees.

Build Industry Support

Fuel and vehicle fees will be easier to enact, and face fewer legal challenges after enactment, if automakers do not oppose these policies. Although vehicle manufacturers are likely to oppose straightforward vehicle fees, they might not oppose a feebate if they believe rebates on more efficient cars can allow them to increase sales by a greater margin than the inefficient car fees will cost them. Right now the opposite tends to be the case: SUVs are the high profit-margin vehicles for manufacturers, and electric vehicles bring in much less profit.

Policymakers should discuss feebate design, such as the feebate rate and the pivot point, with the vehicle industry, attempting to assuage industry concerns. Placing the pivot point so the policy is slightly less than revenue neutral (meaning the feebate is a slight net expenditure) is one way to ensure that vehicle manufacturers, in the aggregate, benefit from the feebate.

Vehicle manufacturers might oppose fuel fees unless they are convinced they will not appreciably reduce demand for their products. Electric vehicle manufacturers, or other vehicles whose fuels are not subject to the fee, might see increased sales of those vehicle models.

Similarly, manufacturers that offer particularly efficient petroleum- powered car models might expect to gain market share from competitors and thus benefit from fuel fees. Manufacturers whose offerings consist of vehicle models that burn carbon-based fuels and are less efficient than competitors’ models are likely to be the hardest to convince to support fuel fees.

Case Studies

Federal Gasoline Taxes in the U.S.

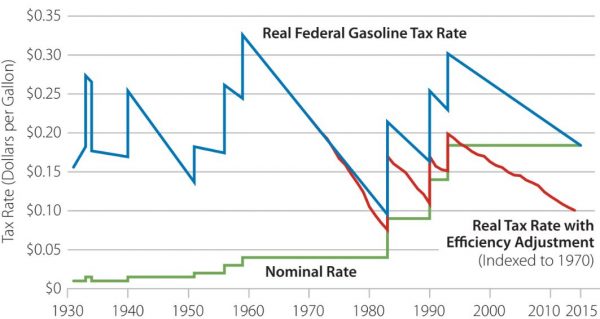

The U.S. federal gasoline tax has achieved only a fraction of its potential because of poor policy design. The U.S. first imposed a gasoline tax of one cent per gallon in 1932. It has periodically been adjusted since then, most recently in 1993. The tax is not indexed to inflation, so over time the true tax value decays (the “real rate”), whereas the tax face value remains constant (the “nominal rate”). However, the tax burden on drivers is also affected by the efficiency of the vehicles they drive; vehicles that go farther per gallon of gasoline result in a lower tax bill per mile for drivers.

Without adjusting for inflation, the U.S. gasoline tax has continuously lost value. Source: Kiplinger.

In real terms, the tax rate is slightly below historical average levels. However, as cars become more fuel efficient, the gasoline tax generates comparatively less revenue than it once would have at the same level. Because gasoline tax revenue is often used to fund infrastructure, the net effect has been less government funding available for road infrastructure construction and maintenance.

Before the interstate highway system, gas tax revenue was devoted to deficit reduction and war spending. In 1956, the Highway Trust Fund was established to help pay for the new interstate highway system, and all gas taxes were devoted to this fund.

For a period in the 1990s, some of the tax revenue was again directed to deficit reduction, but this ended in 1997, because the tax was insufficient to maintain the solvency of the Highway Trust Fund. Since then, the gas tax has proven insufficient, and the Highway Trust Fund has lost money each year. The shortfall will reach $80 billion by 2018.

One important problem with the U.S. federal gasoline tax is the failure to index it to inflation. If the tax had been indexed to inflation starting in the 1930s, no legislative action would have been necessary over the ensuing decades to maintain tax viability, and periods when the tax was allowed to decay for many years (such as 1959–1983 and 1993 to the present day) would have been avoided. This would also have helped ensure the continued solvency of the Highway Trust Fund.

The other major problem with the U.S. gasoline tax is that it does not capture the full value of social harms from driving a gasoline-powered vehicle. Although under the Highway Trust Fund the tax was designed as a means of generating revenue to maintain transportation infrastructure, not account for external costs to society, gas taxes should ultimately rise to the level of social costs generated by driving.

To capture all social costs, the gasoline tax, alongside a fuel use tax, would together need to reflect:

- Climate change damages

- Premature deaths and illnesses from localized air pollutants

- Traffic accidents

- Congestion, lost time, and reduced productivity

- Subsidies and tax breaks received by the oil industry (as these are funded by taxpayers at large, a harm to society)

- Indirect subsidies received by drivers, such as free parking (the cost of which is borne by the government, at least on public roads and in public lots, which are taxpayer-funded)

- Military spending for purposes of protecting oil supplies

Government should strive to internalize the value of all externalities to the extent it is practical.

France’s Bonus-Malus Feebate Program

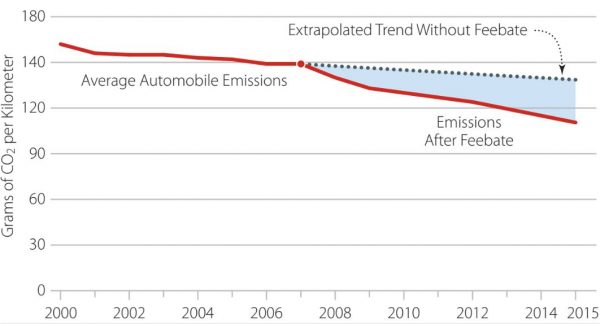

The largest automobile feebate program in the world is the French BonusMalus program. The program entered into force in January 2008 with three goals: steering buyers toward vehicles that emit less CO2, encouraging the development of new low-emission vehicle technologies, and accelerating retirements of old, inefficient vehicles. The pivot point of the feebate is automatically revised downward (requiring vehicles to be more efficient to avoid the fee) every two years, maintaining revenue neutrality.

Like most feebates, the Bonus-Malus program provides a rebate for efficient car buyers, maxing out at €6,300 for the most efficient vehicles, and a fee of up to €8,000 on the least efficient vehicles (as of 2016). The bonus cannot exceed 27% of the vehicle’s cost, and diesel vehicles are not eligible for a bonus. Unlike a traditional feebate, an annual penalty of €160 is assessed on owners of high-emitting vehicles, helping accomplish the goal of accelerating retirements.

One downside to the program is its stairstep function, rather than continuous function, which has only slightly improved efficiency. Manufacturers responded by focusing on vehicles near the step points, allowing them to only incrementally increase efficiency while significantly increasing rebates.

The Bonus-Malus program was successful in accelerating the rate of efficiency gains in the French vehicle fleet. Along with other regional fuel efficiency policies, France’s feebate contributed to a reduction of roughly 25% in CO2 emissions per kilometer through 2015.

France’s feebate drove an improvement in vehicle emissions rate. Source: Agence de l’Environnement et de la Maitrise de l’Energie.

Conclusion

Fuel fees and vehicle feebates are powerful policies for decreasing emissions by reducing driving and by encouraging more efficient vehicles. Fuel fees should reflect the social harms of burning fuel. These fees reduce fuel use and provide a source of revenue to help fund urban mobility projects. A feebate is a powerful incentive to buyers and vehicle manufacturers to opt for more efficient vehicles, and the pivot point can be adjusted to achieve the government’s revenue goals. Together, fuel fees and vehicle feebates can help drive decarbonization of the transportation sector and usher in a clean energy future.