Renewable Portfolio Standards and Feed-In Tariffs

Potential emissions reductions from renewable portfolio standards.

Roughly 30% of greenhouse gas emissions come from burning fossil fuels to generate electricity and heat. But meanwhile, the economic transition from fossil fuels to solar and wind—two electricity sources that don’t generate carbon emissions—is rapidly changing, as prices for both solar and wind continue to drop and technology gets more efficient.

Still, the transition to solar and wind won’t happen organically at the pace needed to decarbonize without strong policy to deploy additional resources. Two of the most successful policies to encourage deployment are renewable portfolio standards (RPS) and feed-in tariffs (FiT). Together, these two policies can contribute about 10% of the cumulative global emissions needed to meet the two-degree Celsius target.

Real-world experience supports FiTs and RPS as effective, low-cost options for accelerating the renewable electricity transition by creating compensation mechanisms for renewable energy generation and expediting deployment. Countries without a well-developed renewable energy market might benefit more from a FiT because it stimulates growth across all technologies and minimizes developer risk. As a market matures, it may transition to a RPS, which empowers the lowest-cost technology to meet a country’s renewable energy needs.

Electricity sector decarbonization is a fundamental step toward deep economy-wide decarbonization. As electricity sector carbon intensity decreases, the electrification of other sectors, particularly building heating and transportation, becomes an increasingly effective decarbonization strategy.

Policy Description and Goal

The goal of an RPS or a FIT is to stimulate the market for renewable generation, which may in turn achieve a combination of public policy goals including reducing air pollution, economic stimulus, and decarbonization. Each policy drives renewable growth, and a well-designed RPS or FIT stimulates the intended amount of new generation without overpaying for new resources.

An important consideration for both RPS and FITs is determining which resources qualify under the policy. The efficacy of either policy in driving down carbon reductions (typically a primary or secondary goal of the policy) depends to a large degree on which resources are included. Policymakers should carefully consider which technologies to include in the policy and ensure that the selected technologies will support the goals of the policy.

Other policies support the deployment of renewables as well, such as tax credits for investment in or production of renewable energy. Although these options may be valuable in certain regions, these policies are not covered in this section.

Feed-In Tariffs

FITs are price-based renewable energy procurement mechanisms, under which policymakers set and consumers pay a guaranteed price, often at a premium, for each unit of energy produced by qualifying renewable power plants. A FIT typically includes three provisions: guaranteed grid access, consistent long-term purchase agreements, and payment based on cost, value, or competitive bidding of renewable generation technologies. FITs are typically technology specific (e.g., wind may receive one price, and solar or biomass receives another). However, policymakers may choose, for a range of reasons, to use other mechanisms, including reverse auctions, competitive bidding, or avoided cost tests, to determine a single project-level price.

Key design elements for FITs include:

- Whether and how the tariff differentiates between different technologies, project sizes, locations, and other attributes

- Which renewable technologies are eligible to receive the tariff

- How the tariff accounts for changes in the value of money (i.e., inflation)

- In a restructured market where generators compete to provide electricity, whether the tariff is fixed or varies with the spot price for electricity

- Duration of FIT payments

- The amount of energy or power available for the tariff

- Whether and how the tariff changes over time to reflect changes in the cost or value of technology

- Whether the procurement relies on an auction mechanism to set the tariff or whether the price is administratively determined

Renewable Portfolio Standards

RPS set procurement targets that typically require load-serving entities (LSEs), companies such as utilities that deliver electricity to customers, to procure a fixed portion of their generation from a defined set of eligible renewable sources by a certain date (e.g., “25% wind and solar by 2025”). The goals are typically binding on LSEs, creating penalties for noncompliance. However, some RPS are voluntary.

Compliance with RPS is generally tracked through a credit system. The LSE must hold credits that represent the renewable attributes of a unit of energy—a “Renewable Energy Credit.” RECs (RECs) are conveyed to renewable generators based on the volume of electricity generated by a qualifying power plant (e.g., one megawatt-hour [MWh] of wind might generate one REC). A RPS can allow LSEs to obtain credits by purchasing them on an open market, by contracting with suppliers of renewable electricity to obtain legal ownership of the credits as they are produced, or by producing their own credits by owning and operating renewable power plants. Whether a RPS allows RECs to be sold separately from the electricity, called unbundled RECs, depends on the specific RPS language.

RPS generally ascribe RECs equally to all qualifying renewable technologies. However, some RPS allow certain technologies, project sizes, or geographies to generate extra RECs or sometimes set aside a specific share of credits that must come from a single technology type (typically called a carve-out) in order to stimulate investment in specific technologies or regions. By using a tradable credit system, a RPS leverages market dynamics to reduce the price of compliance for LSEs.

Key design aspects to consider for a RPS include:

- What entity is required to meet the RPS

- Which technologies, geographies, and vintages qualify for RECs

- Whether there are carve-outs for specific technologies

- Whether RECs can be banked and transferred across years

- What target and timeline are realistic given the current state of the market

- Whether RECs are bundled (directly linked) with generation or may be unbundled and traded without regard to the purchase of renewable generation itself

- If LSEs are allowed to purchase RECs from other jurisdictions, how the RPS complies with any trading or commerce rules (e.g., interstate commerce in the United States), how renewable energy credit definitions can be coordinated across jurisdictional lines, and how to avoid double-counting RECs that are traded

- Whether there are cost caps, called alternative compliance payment rates, and what value they should be set at

- Whether there is a minimum plant size to generate RECs and what that size is

- Whether the entity at the point of regulation has the option to pay a fee, called an alternative compliance payment, to satisfy its requirement, what that fee is, and the use of any fees collected

- Whether the RPS should be a set target in a specific year or, instead, a rate of improvement, thereby encouraging long-term, predictable progress

FITs and RPS can be complementary and in some cases combined. For example, some U.S. states use a FIT to support small-scale renewable energy and a RPS to incent utility-scale buildouts to meet overall renewable energy goals. It does not make sense to use both a FIT and a RPS for the same technology at the same time, however.

When to Apply These Policies

When to apply a FIT or an RPS depends on at least three factors:

- The maturity of the domestic renewables industry

- Technological diversity and renewable resource supply

- Experience with market-based pricing in the electricity industry

Feed-in Tariffs

By driving new generation online through a set price guaranteed for a defined period, FITs provide transparent, consistent revenue to renewable energy providers. This lowers risk to developers who may be uncertain whether they could generate sufficient revenue to cover the cost of the project over the lifetime of the investment.

The revenue certainty that FIT payments provide can be particularly valuable for nascent industries and technologies that require significant investment to move from commercial demonstration to market maturity. For example, Germany’s €150-per-MWh FIT for offshore wind in 2009 drove a rapid expansion of offshore wind production, which has helped drive prices down significantly. From 2009 to 2016, Germany’s offshore wind capacity grew from 40 megawatts (MW) to 4,130 MW, making Germany responsible for 29% of global capacity. In 2017, German offshore wind developers were able to put together a long-term contract without subsidy, reflecting the success of early policies in driving down prices for a new technology that ended up being competitive in the open market.

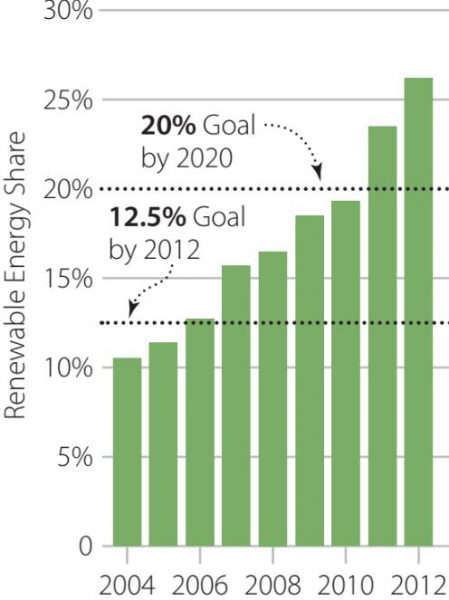

Share of renewable energy in Germany 2004-2012. Source: Fraunhofer Institute.

However, when prices are set administratively, FITs can do a poor job of hitting precise targets and controlling costs. In the German example described earlier, FITs were in place for offshore wind since 2004 but produced virtually no investment in offshore wind facilities until 2009. On a broader scale, Germany has not managed to tightly control the amount of payments flowing to renewable energy sources. For example, in 2004 Germany set goals of 12.5% renewable generation by 2012 and 20% by 2020 alongside the set prices paid via FITs to meet those goals. By the time the goals were amended in 2012, Germany had already generated 26.2% of its electricity from renewable sources, at significant cost to customers.

As a result, Germany and other countries have implemented adjustments to their FITs that take market development and falling costs into account. These adjustments included a “reverse auction” mechanism, which can be very effective when the desired quantity of renewables in the mix is known. In a reverse auction, policymakers open a market for a fixed quantity of renewable energy, and developers bid to provide those renewables at a competitive price. The lowest bid price wins, and the funds are then rewarded as projects produce power. This avoids setting prices administratively, so it can result in much better cost efficiency.

In sum, although FITs can be designed to support renewable investment in mature markets, they are a particularly valuable tool in nascent, less-developed renewable markets and where there is low experience with market-based pricing in the electricity industry. In these arenas, FITs can drive investment and can help lower technology costs as increasing deployment results in economies of scale and learning by doing (where the process of building and installing new sites results in process improvements that lower costs).

Renewable Portfolio Standards

The strengths of RPS are twofold: policy certainty and market-based pricing. By setting standards and targets rather than prices, RPS create policy certainty that renewable energy goals for the power sector will be met.

Policy certainty for RPS depends on policy design, and it is significantly higher if three conditions are met:

- LSEs that are bound by the standard must have sufficient revenue to procure the RECs. Typically, RECs are financed by charges passed through to retail customers, which forms a consistent base of revenue. However, these charges can be fixed, based on estimated compliance costs, or they can be variable, based on actual REC prices and the level of procurement. When REC budgets are based on fixed charges, whether the RECs are purchased by the state (as in the case of New York) or by the LSE (as in most other regions), using a fixed charge can result in too small a budget to support the RPS target. When this happens, REC purchasers will not have enough revenue to purchase the required quantity of RECs and will fail to achieve RPS targets.

- Second, the RPS must have a strong enforcement signal to LSEs that fail to meet the standard. Usually this is applied through alternative compliance payments, better known as penalties, that the LSE must pay if it fails to meet RPS targets. These penalties must be high enough to discourage LSEs from missing RPS targets.

- Third, the RPS must provide sustainable revenue to the developer, whether through long-term contracts for renewable energy or by procuring RECs over the lifetime of the renewable generator. Failure to satisfy these three conditions can result in a deficiency of RECs (i.e., not enough projects being built) that can undermine the success of the RPS program.

A single benefit of a RPS is that it is price finding, which will control costs if the market is competitive. There are at least two kinds of market designs: a centralized spot market and auction-based REC procurement. Spot markets create a central clearinghouse for RECs where buyers can buy RECs at least cost. Auctions publish quantities of RECs demanded by the LSE and solicit developers to compete on a one-time price to provide them, usually leading to a long-term contract. Spot markets are economically efficient in theory because renewable generators compete to provide RECs, allowing buyers to get the cheapest RECs rather than locking in prices in a contract. However, this benefit may be offset by the risk it creates for developers, which will require them to increase their bid prices.

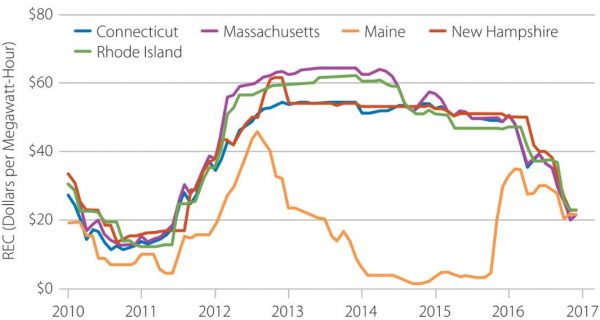

REC prices can vary significantly from year to year depending on both the interaction between supply and demand and policy certainty. For example, RPS compliance often allows banking: Utilities may take advantage of attractive prices or available development today and use banked credits in future years, causing prices to fall. In other situations, land scarcity or lack of transmission may result in high prices. Some jurisdictions enforce RPS through alternative compliance payments for each MWh utilities fall short of the RPS. If these payments are lower than the actual cost, utilities may rationally choose to pay penalties to save their customers money.

Renewable energy credit prices can vary substantially year to year. Source: Lawrence Berkeley National Laboratory.

Whether auctions or spot markets produce the lowest cost depends on the maturity of the renewable energy marketplace. For mature technologies that are cost-competitive with traditional power plants, REC price fluctuations will be a modest barrier, whereas less mature technologies will probably provide energy most cost-effectively under long-term contracts.

RECs are also generally technology neutral, which reduces compliance costs for consumers but may create barriers to entry for fledgling industries. RPS auctions allow all renewable sources to compete as long as they qualify under the RPS. More mature, cheaper renewable technologies are therefore favored at the expense of high-potential, nascent technologies that need opportunities for deployment and higher revenue streams in order to realize significant cost declines. Not only will this crowd out potential new industries and foreclose potential supply chain or soft cost breakthroughs, it reduces the diversity of the renewable energy fleet—a crucial feature needed to reach high penetrations of renewable energy at a reasonable cost.

One way to mitigate this impact is to use a carve-out, which specifies a fraction of the total RPS that must be achieved using a certain technology or set of technologies. For example, many RPS historically had carve-outs for solar photovoltaic (PV), which require a minimum fraction of the RPS to be met exclusively by this technology, and this helped drive the amazing price reductions in solar PV. Central station solar power plants would be a good candidate for this approach today.

Another approach is to use a tiered RPS, where different resources are included in different tiers. For example, tier I resources might include strictly zero-emitting technologies such as wind and solar, and tier II resources might include a broader set of renewable technologies such as biomass and waste-to-energy, with fewer credits per unit of electricity generated.

What About Nuclear Power?

At the time of this writing, renewable energy is often more cost-effective than new nuclear power. In some regions, though, new nuclear power is a cost-effective source of zero-emission energy. Additionally, many regions have already built significant amounts of nuclear capacity. For example, the U.S. has roughly 112 gigawatts (GW) of nuclear capacity today, and China has roughly 48 GW of capacity. Worldwide, there are 359 GW of nuclear capacity today. Furthermore, the next generation of nuclear reactors may prove much more cost-competitive than today’s reactors, opening the possibility for a significant expansion of nuclear power.

RPS can be modified to include all zero-carbon generation sources, including nuclear power. When a renewable portfolio is broadened to include more technology types, it is sometimes called a clean energy standard. Under a clean energy standard, policymakers set a goal for utilities to generate a certain amount of electricity from zero-carbon electricity technologies, including nuclear power plants and renewables. As with RPS, clean energy standards rely on a credit system, sometimes called zero-emission credits, akin to RECs.

In some regions with competitive electricity markets and low market prices, which can happen for several reasons, existing reactors have struggled to remain profitable and are facing closure. For example, as many as two-thirds of the nuclear power plants in the U.S. may be operating at a loss in today’s markets. Existing nuclear can be one of the most cost-competitive sources of emission-free electricity in certain regions, creating a sound policy basis for paying these plants for their zero-emission attribute to ensure they remain viable.

Facing early closure of nuclear stations and the potential loss of a significant share of carbon-free generation, some states have turned to implementing clean energy standards. To date, most clean energy standards in the U.S. have focused on providing compensation for existing nuclear facilities. In most instances, clean energy standards have implemented a zero-emission credit exclusively for nuclear power plants, in addition to RECs, to ensure adequate revenue to keep nuclear plants in the black and avoid undermining the incentive of RECs to help drive new technologies into the market.

As renewable technologies such as solar panels and wind turbines mature over the long run, policymakers might consider evolving RPS to clean energy standards that focus on clean energy generation from all sources. Such a policy could help push new technologies to market while ensuring that existing carbon-free technologies are compensated for this attribute.

Policy Design Considerations

A number of policy design principles apply to both FITs and RPS.

Create Long-Term Certainty to Provide Businesses With a Fair Planning Horizon

Long-term certainty is a central element of both FITs and RPS.

FITs should guarantee compensation for renewable generators for a reasonable time period (at least 10 years and up to 30) that provides investors with certainty they will receive a reasonable return on investment. Guaranteed payback periods should align with the projected lifetime of the generation technology, although they can be front-loaded to provide certainty while reducing long-term risk for the off-taker. For example, wind and solar plants typically have lifetimes of 20 years, so power purchase agreements to comply with RPS should be structured as 10- to 20-year fixed prices for each unit of energy. Likewise, FITs should provide a consistent payment for each technology. Each measure lowers the financing risk, reducing the cost of capital and risk of default or poor performance.

RPS must have a long time horizon in order to give LSEs enough time to comply with the standard. Procuring RECs requires building new renewable generation plants, which can take a significant amount of time. LSEs and their partners must identify and permit sites, conduct interconnection studies, and negotiate contracts over the course of a few years before construction on the plant and associated transmission infrastructure even begins. RPS goals should allow this development to occur on an ambitious but reasonable timescale. A clear long-term signal will also support negotiations with renewable energy providers who need confidence they will receive consistent revenue from the REC transaction, whether it is bilateral or spot market based. RPS therefore should set targets for at least a 10-year period, with 15 or 20 years being preferable, and interim goals for intervening years.

A key aspect of long-term consistency for both a FIT and a RPS is ensuring that revenue is available to pay for either. One approach is to use a fixed budget to fund these programs, as described earlier, wherein funding for renewable energy purchases is generated through a fixed tariff based on an ex ante assessment of compliance costs. The second approach is to first obtain the amount of renewable energy needed and then collect the necessary revenue from customers. Using a fixed budget is a less effective approach because the money allocated for renewable procurement must be flexible enough to accommodate rapidly changing market conditions. In the second approach, spreading the cost over a large group of customers, who will almost certainly continue buying power from the provider, provides revenue certainty and minimal financial disruption to consumers. It also neatly ties revenue collection to system use.

Use a Price-Finding Mechanism

If countries have a renewable energy target in mind and value cost- effectiveness over other attributes, they should consider adopting a RPS rather than a FIT. FITs generally use administratively set prices to compensate renewable energy generators and therefore are not ideal price-finding mechanisms. A FIT can be modified to do a better job of adjusting to changing costs, for example, by using a reverse auction to find prices for certain technologies and then using the auction price as the tariff price.

RPS using open solicitations, particularly reverse auctions, are superior price-finding mechanisms, particularly in more mature markets. In meeting a RPS, LSEs can “find” the price of RECs in at least two ways: reverse auctions and spot markets. The more common reverse auction sets the quantity and defines the characteristics (e.g., development deadline, location, duration) of renewable generation desired and opens up a bidding auction through which prospective developers offer a price per unit of generation over the lifetime of the asset to the LSE. Once all bids are received, the LSE chooses the developers who meet the desired characteristics and bid the lowest prices, and it negotiates long-term contracts for the RECs and associated generation with the auction price as the basis. As long as there is robust participation in the auction, or entrants are not arbitrarily barred from participating, reverse auctions are powerful, effective price-finding mechanisms.

However, auctions are cost-effective only when there is adequate participation. LSEs are often the only buyer in a given country or region, so policymakers must take care to ensure that the LSE is operating auctions in a way that encourages competition. In all cases, LSEs must publicize the auction far ahead of time, including reaching out to prospective developers operating in the region well in advance of the auction, clearly defining the bid requirements, and sharing pro forma bids with customers to facilitate the bidding process. For LSEs that own and operate renewable generators, regulators must also decide whether the LSE should be allowed to participate in auctions against competitors and, if so, how to ensure fairness around the LSE’s final selection.

Spot markets for RECs find prices through the interaction between supply and demand over time. These markets require a high degree of market maturity because the value of the REC will change over time, introducing risk for developers. Similarly, renewable power producers may bid higher REC prices to account for this risk, which would increase REC prices. Still, spot markets can be useful for driving down RPS compliance costs, particularly when they span multiple, coordinated regions, increasing supply-side competition. For example, an interstate REC spot market would allow LSEs in one country to comply with a RPS by taking advantage of plentiful resources in another.

Eliminate Unnecessary “Soft Costs”

There are at least three key aspects to reducing soft costs for renewable energy that support the success of RPS and FITs: siting, transmission access, and transaction costs. Siting renewable energy, or finding a place to put it, can be a time-consuming regulatory process that adds risk and costs to development. Permitting and site contracting add significant costs and delays and may ultimately kill projects, particularly for large-scale renewable energy and the transmission to access world-class wind and solar resources. Transaction costs are higher when renewable developers face uncertainty over whether they can sell their kilowatt-hours to creditworthy counterparts over the project’s useful life.

Reward Production, Not Investment, for Clean Energy Technologies

Both RPS and FITs generally are structured to reward production, not investment in clean energy technologies. FITs are structured to compensate renewable generators based on each unit of electricity generated. Similarly, a REC is created for each unit of electricity generated by a renewable power plant.

These policies can be contrasted with capacity targets on one hand and investment incentives on the other. Capacity targets mandate the construction of a given quantity of renewable power capacity. These targets create several problems, many of which have been evident in China (discussed later in this section). First, although they may stimulate rapid market development, they do not necessarily guarantee the renewable generator is connected to the grid or generating power at full technical potential. Second, unless projects are owned by public utilities, capacity targets may not provide the consistent revenue streams needed to reduce the cost of renewable investment.

Likewise, investment incentives on a capacity basis can be effective stimulants for clean energy investors. However, investment incentives may not guarantee or even incentivize system performance along the lines of developer projections. For example, although investors may receive an incentive to build a large wind farm, the off-taker (the company purchasing the electricity directly from the power plant) may still bear the risk of maintenance issues, under-generation or over-generation, and inaccurate wind forecasting.

Ensure Economic Incentives are Liquid

RPS and FITs must balance incentive liquidity with the need to encourage consistent performance over the lifetime of the asset. Making economic incentives available for recovery too early may reduce developer motivation to perform for the full lifetime of the system, and drawing incentives out for too long may increase developer risk and system costs.

FITs are sometimes structured as tax credits rather than direct payments for each unit of electricity generated. For example, in the United States wind power receives a production tax credit of $23 per MWh of electricity generation. Often, the entities that earn the tax credits don’t have enough qualifying income to offset with the tax credits. Therefore, to take advantage of the credits they are forced to partner with tax equity investors, entities that have sufficient qualifying tax liabilities. These entities are generally investment banks and other large financial institutions.

There are several problems with this approach. First, the tax equity investor typically takes more than 50% of the value of the tax credits, so less than half of the government’s subsidy ends up being used to promote the subsidized activity. Second, because of problems in financial markets, tax equity investors may be unable to maintain the required level of taxable income over the period of the contract. Third, it is a barrier to small- and mid-scale renewable projects because tax equity investors are not interested in becoming involved in small projects. By using tax credits instead of grants, this program increases project costs and underutilizes taxpayer money.

Build in Continuous Improvement

FITs should improve over time by closely tracking the cost of installations and adjusting the administrative price accordingly. Policymakers should continue providing compensation but ramp down prices over time as confidence improves, price points become more apparent, and industries mature. Likewise, FITs should expand to cover new technologies that are reaching commercialization but lack a market for deployment.

Continuous improvement for RPS can take two forms: First, RPS targets can be raised at regular intervals—although this should be done well before the expiration of the older targets, to keep the markets healthy. A more powerful method would be to set an annual increase in required RECs, such as 3% per year, rather than a plateau target. This would create a great investment signal and would make maximum use of political capital at the time the program is established.

Finally, it is important that a RPS not just require compliance at the end of the program year; instead, it should implement consistent interim goals to provide consistent signals to investors and avoid dropoffs if LSEs take an irregular, particularly back-loaded, procurement strategy. It may be advisable to create a banking-and-borrowing system to allow for the lumpiness of project development. Banking and borrowing allow over-compliance or under-compliance in any given year, as long as the total RECs match the total REC requirement over a multiyear (e.g., four-year) period.

Focus Standards on Outcomes, not Technologies

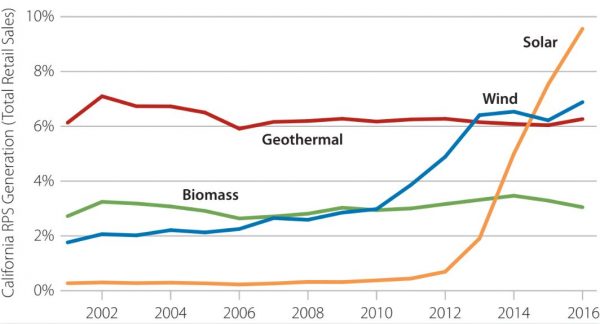

This principle applies specifically to RPS. By placing the onus on LSEs to procure a portion of renewables regardless of type, RPS do a superior job of following a technology-finding path and reducing costs compared with FITs. For example, California saw wind and biomass production outpace solar in the initial phase of its RPS from 2002 to 2012, but as solar costs have dropped dramatically, solar has overtaken wind and is now the most prevalent technology used to meet the RPS.

California’s renewable portfolio standard allows for the lowest-cost resources to meet the target as prices evolve. Source: U.S. Energy Information Administration.

In specific instances, it may make sense to use carve-outs for specific technologies (which violates this principle), but over time as technologies mature and costs fall, carve-outs should be phased out.

Prevent Gaming via Simplicity and Avoiding Loopholes

For REC markets to function properly and stimulate additional investment, there must be a clear tracking system for the RECs. In the U.S., each renewable MWh receives a unique ID number for each REC, based on electronic data supplied by transmission operators that can verify the generation. The tracking system then “retires” RECs when they are purchased, usually by an LSE complying with the RPS. These robust systems prevent double counting, and allow trading across borders if tracking systems are linked and RPS requirements are sufficiently similar, much like cross-border carbon markets.

REC markets should also have clear deliverability requirements. Policymakers must decide whether RECs must be deliverable to grid in the policy region or whether unbundled RECs (when purchasing RECs is separate from purchasing electricity) from other regions qualify under the RPS. For example, the lowest-cost compliance option is usually to allow RECs from all regions qualified by policymakers to participate in a RPS. However, this will result in some projects being developed outside the policymaker’s region. Consequently, the RPS may have only limited economic or emission impact in the region in which it is established.

Similarly, allowing RECs from multiple regions under a single region’s RPS requires that the participating regions have similar definitions of renewable resources. For example, Pennsylvania includes coalbed methane as a renewable energy source, but other states do not allow this resource to qualify under their RPS. Thus, if interregional RECs are allowed under a RPS program, policymakers must identify a way to align different RPS definitions.

Case Studies

United States

The U.S. has no national renewable energy policy other than a FIT for wind generation that takes the form of a production tax credit of $23 per MWh and a capacity-based investment tax credit for other renewable generation technologies. Instead, the U.S. leaves most renewable energy policy to the states, which have significant control over their energy mix.

A total of 29 states have RPS that vary in structure and ambition, covering 55% of national generation. Some have carve-outs for certain types of resources, and others leave mature technologies such as large hydroelectric generation out of the standard. Most states have adopted net metering, under which small-scale solar generation receives credit on customer bills at the full retail rate of electricity. Together, these policies have created a diverse, dynamic investment environment where renewables have thrived.

California was an early adopter of the RPS in 2002 and has been a leader in renewable energy ever since; today California leads the U.S. in renewable energy capacity and generation and has the most solar generation by percentage, at 13.8% in 2016, due in large part to continuous improvement in the state’s policy. California currently has a RPS of 50% renewable generation by 2030, excluding large hydroelectric power and small-scale customer-owned generation, which receives a FIT through net metering. California’s LSEs have consistently outpaced their RPS requirements, taking advantage of an attractive investment environment and raising certainty of compliance. This high performance gave California legislators confidence to raise the initial RPS of 20% by 2017 (enacted 2002) to 20% by 2010 (enacted 2006), 33% by 2020 (enacted 2011), and finally 50% by 2030 (enacted 2015).

The California RPS uses a technology- and price-finding reverse auction system whereby LSEs issue requests for generator bids, and qualifying generators respond with bids for long-term contracts for both RECs and the underlying generation (“bundled” RECs) that allow LSEs to meet their generation mandates. This has kept compliance costs low; for example, from 2012 to 2014, California’s RPS compliance yielded cost savings. However, California’s compliance options are limited by geographic constraints. Policies to generate at least 70% of the RECs in state help promote economic and industry development, but they do limit the options for out-of-state, possibly more economical resources to compete and may increase compliance costs.

Additionally, California’s RPS is technology finding, resulting in a rapid procurement of solar, because there are few other competitive options to choose from in-state. But RPS compliance costs have risen, even as the share of solar has grown with simultaneous cost declines. This is also creating problems for the grid: A glut of daytime solar generation on low-demand days has led to curtailment of solar. New complementary policies to diversify the resource mix, particularly greater access to out-of-state renewable resources such as wind, geothermal, and hydro, can help lower the costs of meeting the 50% RPS.

China

China is an international leader in both coal-fired and renewable energy. China has the most renewable energy capacity of any country, including 148 GW of wind, 77 GW of solar, and 332 GW of conventional hydroelectric as of 2016. China is aiming to continue this development, with a goal of surpassing 210 GW of wind and 110 GW of solar by 2020.

China has three complementary renewable energy policies: a FIT, renewable generation goals, and renewable capacity targets. China’s FIT is a conventional design; since 2003 renewable technologies have received compensation per kilowatt-hour generated, at rates particular to each technology. To ensure the FIT is following the cost closely, Chinese state-owned grid companies issue auctions for certain technologies to find the price, and this new auction result sets a new all-in price for renewable energy from that technology. In addition, the FIT varies for different regions based on resource availability. In wind-rich regions, for example, the FIT is lower and increases where wind is scarcer.

However, despite consistent compensation for generation, curtailment of available wind and solar generation has been a persistent problem in China, because the capacity targets reward investment, not performance. For example, in 2016, 21% of wind power was wasted. Although developers have every incentive to perform under the FIT structure, the grid managers, LSEs, and local governments have little incentive to accept the energy and pay the generators, as the overriding concern for government officials and state-owned enterprises has been meeting the capacity targets from the 13th Five-Year Plan. As a result of rewarding capacity and not generation, China’s investment in new renewable energy facilities has equaled or outpaced the rest of the world since 2010, but many generators are unconnected to the grid or are routinely curtailed in favor of thermal generation, often coal.

China’s system falls short of several other design principles; by relying on capacity targets and a technology-specific FIT, it fails to be technology and price finding. Recently, the Chinese government signaled that it may begin adjusting FITs more often, improving the price-finding quality of its renewable energy policy. In addition, recognizing the curtailment issue, China has begun to experiment with a RPS–driven REC trading system to allow interregional renewable trading and reduce reliance on technology-specific FITs and capacity targets.

Still, China has seen important successes, particularly in reducing soft costs and applying continuous improvement. The proactive development of east– west transmission helps reduce soft costs by providing access to wind-rich generation and transmitting it directly to load centers where it can be consumed. Furthermore, Chinese developers get access to low-interest loans from state-owned development banks, reducing the cost of capital for new projects. Continuous improvement of the capacity targets has likewise resulted in consistent progress and renewable investment that laid the foundation for tremendous success. In driving a staggering share of global demand, China has also become the dominant solar PV manufacturer, with 70% of global production capacity in 2012.

Germany

Germany has some of the most ambitious renewable energy targets in the world, at 40%–45% by 2025 and 55%–60% by 2035. So far, Germany’s FIT has been the principal driver for its rapid adoption of renewable energy since it began setting renewable energy goals in 2000. The FIT is set for a 20-year term, it varies by technology, and the tariff level is set at regular intervals.

Until recently, Germany has not had a price-finding FIT, and as a result the cost impacts of its rapid adoption of renewable generation have been high. Today, the renewable surcharge on customer bills averages just under 25% of the total electricity rate, although many industrial customers are exempt from this surcharge to remain globally competitive. To mitigate these costs and shift some risk onto maturing renewable generation industries, Germany moved from a pure FIT to a feed-in premium, which lowers the amount of compensation but allows generators to also collect revenue from wholesale energy markets. As a result, renewable generators whose costs are covered largely by the feed-in premium can compete in wholesale energy markets, driving down the price of electricity for consumers.

To become more price-finding, Germany changed its FIT to adjust downward based on renewable energy auction results, conducted annually. Additionally, FITs are front-loaded, with higher compensation for the first 5–10 years, depending on technology, and reduced each year thereafter. In these ways, Germany hopes to reduce the cost of its renewable transition while stimulating investment sufficient to meet its decarbonization goals.

Conclusion

It is clear from experience that both FITs and RPS can be effective, low-cost options for accelerating the renewable electricity transition. A country with immature renewable energy markets may benefit more from a FIT, which minimizes developer risks and stimulates growth of all renewable technologies. A RPS may be more appropriate as the market matures, allowing the lowest-cost technology to meet a country’s renewable energy goals. Each policy can be tweaked to compensate for its perceived weaknesses; in many cases, the two policies can even be used successfully together.

Decarbonizing the electricity sector is a fundamental step toward deep economy-wide decarbonization. As the carbon intensity of the electricity sector decreases, the electrification of other sectors, particularly building heating and transportation, becomes an increasingly effective decarbonization strategy. Both policies can get countries far along the path to decarbonizing the electricity sector; whether that is cost-effective depends as much on the policy designs contained in this chapter as on a country’s ability to adapt its renewable energy policies to changing market conditions.